Navigating the New Landscape: Highmark - Your Partner for Corporate Tax in the UAE

The implementation of corporate tax in the UAE in 2023 marked a significant shift in the country's economic landscape. While offering new opportunities, it also presents complexities for businesses. Highmark Accountants, a leading firm of Corporate Tax Consultants in the UAE, stands ready to guide you through this new era with comprehensive support and expert advice.

Understanding Corporate Tax in the UAE: A New Reality for Businesses

The UAE introduced a federal corporate tax regime with a standard rate of 9%. However, certain entities benefit from exemptions and incentives. Here's a breakdown of the key aspects to consider:

Taxable Profits: Corporate tax applies to taxable profits earned by businesses operating in the UAE mainland. These profits are calculated after deducting allowable expenses from gross revenue.

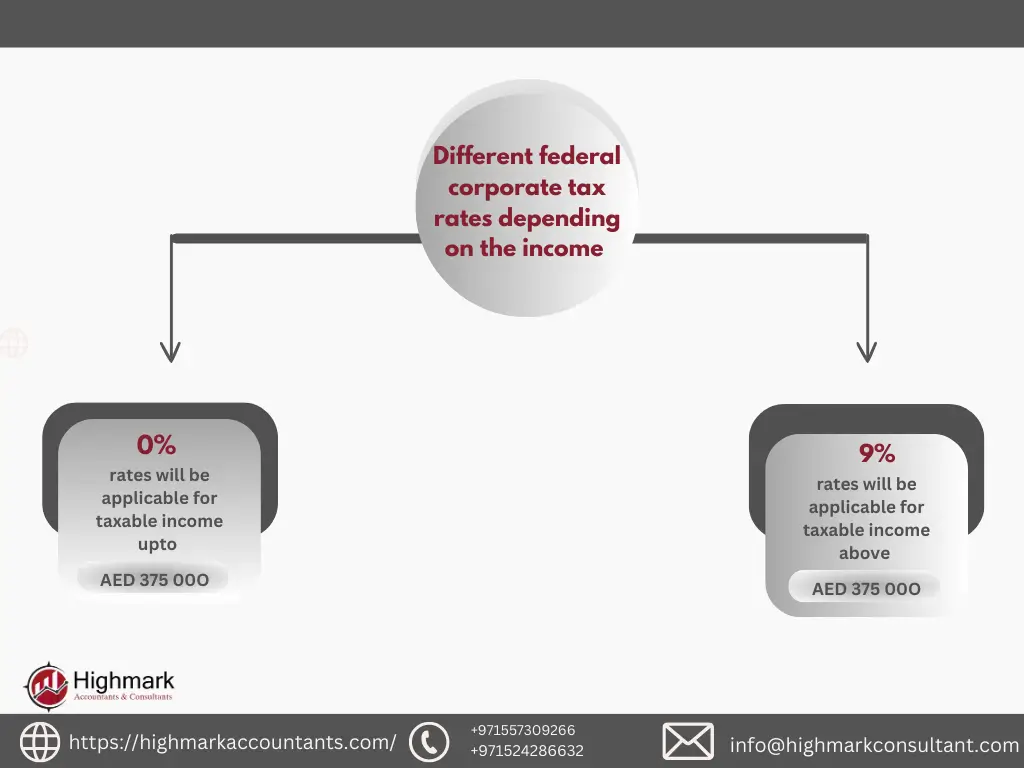

Tax Rates: The standard corporate tax rate is 9%. However, a 0% tax rate applies to taxable income up to AED 375,000. A separate tax rate (yet to be specified) will apply to large multinationals meeting specific criteria.

Free Zones and Exemptions: Businesses operating in designated free zones may be eligible for full or partial corporate tax exemptions. Additionally, specific industries and activities may benefit from tax exemptions or incentives.

Why Choose Highmark as Your Corporate Tax Consultants in the UAE?

Navigating the intricacies of corporate tax can be challenging. Highmark offers a team of experienced and qualified Corporate Tax Consultants in the UAE to provide you with the guidance and support you need:

Tax Registration and Compliance: We assist with registering your business for corporate tax purposes and ensure you comply with all filing deadlines and reporting requirements.

Tax Planning and Optimization: Our team works with you to develop a tax-efficient strategy that minimizes your tax liability while remaining compliant with UAE regulations.

Tax Calculations and Return Preparation: We handle the complex calculations involved in determining your taxable income and prepare accurate tax returns for submission to the Federal Tax Authority (FTA).

Liaison with Tax Authorities: We can represent you before the FTA, addressing any queries or challenges you may face during the tax assessment process.

Staying Updated on Regulations: Our team continuously monitors changes in UAE corporate tax regulations and informs you of any updates that may impact your business.

Beyond Compliance: Highmark's Comprehensive Services

Our expertise extends beyond ensuring basic compliance with corporate tax regulations. Highmark offers additional services to empower your business for success:

Transfer Pricing Services: If your business conducts transactions with related parties, we can guide you on transfer pricing regulations to avoid any potential tax disputes.

Tax Due Diligence: Considering a merger or acquisition? We conduct tax due diligence to identify potential tax liabilities associated with the target company.

Tax Dispute Resolution: In the event of a tax dispute with the FTA, we can represent you and negotiate a favorable resolution.

Tax Training: Our team can provide training workshops for your staff, equipping them with the knowledge to manage your tax affairs effectively.

Adapting to Change with Confidence

The introduction of corporate tax in the UAE presents both challenges and opportunities. By partnering with Highmark, you gain a team of dedicated Corporate Tax Consultants in the UAE who can help you navigate the complexities of the new tax regime and ensure your business remains compliant and optimized for long-term success.

https://highmarkaccountants.com/corporate-tax/Navigating the New Landscape: Highmark - Your Partner for Corporate Tax in the UAE

The implementation of corporate tax in the UAE in 2023 marked a significant shift in the country's economic landscape. While offering new opportunities, it also presents complexities for businesses. Highmark Accountants, a leading firm of Corporate Tax Consultants in the UAE, stands ready to guide you through this new era with comprehensive support and expert advice.

Understanding Corporate Tax in the UAE: A New Reality for Businesses

The UAE introduced a federal corporate tax regime with a standard rate of 9%. However, certain entities benefit from exemptions and incentives. Here's a breakdown of the key aspects to consider:

Taxable Profits: Corporate tax applies to taxable profits earned by businesses operating in the UAE mainland. These profits are calculated after deducting allowable expenses from gross revenue.

Tax Rates: The standard corporate tax rate is 9%. However, a 0% tax rate applies to taxable income up to AED 375,000. A separate tax rate (yet to be specified) will apply to large multinationals meeting specific criteria.

Free Zones and Exemptions: Businesses operating in designated free zones may be eligible for full or partial corporate tax exemptions. Additionally, specific industries and activities may benefit from tax exemptions or incentives.

Why Choose Highmark as Your Corporate Tax Consultants in the UAE?

Navigating the intricacies of corporate tax can be challenging. Highmark offers a team of experienced and qualified Corporate Tax Consultants in the UAE to provide you with the guidance and support you need:

Tax Registration and Compliance: We assist with registering your business for corporate tax purposes and ensure you comply with all filing deadlines and reporting requirements.

Tax Planning and Optimization: Our team works with you to develop a tax-efficient strategy that minimizes your tax liability while remaining compliant with UAE regulations.

Tax Calculations and Return Preparation: We handle the complex calculations involved in determining your taxable income and prepare accurate tax returns for submission to the Federal Tax Authority (FTA).

Liaison with Tax Authorities: We can represent you before the FTA, addressing any queries or challenges you may face during the tax assessment process.

Staying Updated on Regulations: Our team continuously monitors changes in UAE corporate tax regulations and informs you of any updates that may impact your business.

Beyond Compliance: Highmark's Comprehensive Services

Our expertise extends beyond ensuring basic compliance with corporate tax regulations. Highmark offers additional services to empower your business for success:

Transfer Pricing Services: If your business conducts transactions with related parties, we can guide you on transfer pricing regulations to avoid any potential tax disputes.

Tax Due Diligence: Considering a merger or acquisition? We conduct tax due diligence to identify potential tax liabilities associated with the target company.

Tax Dispute Resolution: In the event of a tax dispute with the FTA, we can represent you and negotiate a favorable resolution.

Tax Training: Our team can provide training workshops for your staff, equipping them with the knowledge to manage your tax affairs effectively.

Adapting to Change with Confidence

The introduction of corporate tax in the UAE presents both challenges and opportunities. By partnering with Highmark, you gain a team of dedicated Corporate Tax Consultants in the UAE who can help you navigate the complexities of the new tax regime and ensure your business remains compliant and optimized for long-term success.

https://highmarkaccountants.com/corporate-tax/