5D Lottery: how to play and win

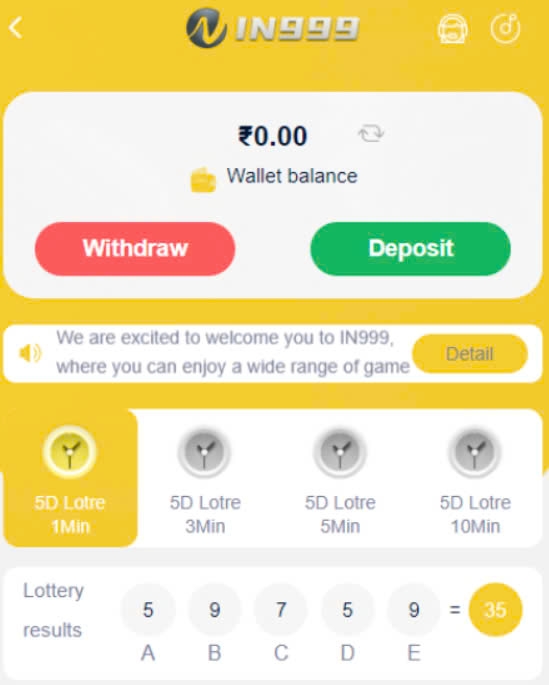

The 5D Lottery on In999 is an engaging game where players select a unique five-digit number, ranging from 00000 to 99999. Winning is determined by matching the drawn numbers in exact order, with substantial prizes for precise matches and potential rewards for partial matches.

How to Play the 5D Lottery on In999:

Log In to Your Account: Access your In 999 account by visiting the official website or using the mobile app. If you're new to the platform, you'll need to register an account.

Navigate to the Lottery Section: Once logged in, go to the "Lottery" section to view available games.

Select the 5D Lottery: Choose the 5D Lottery option from the list of games.

Pick Your Numbers: Select a five-digit number combination of your choice. You can manually choose each digit or use a random number generator if available.

Purchase Your Ticket: After selecting your numbers, confirm your entry and proceed to purchase the ticket. Ensure you have sufficient funds in your account to complete the transaction.

product link: https://in999.best/5d-lottery-how-to-play-and-win/

or: https://portfolium.com/entry/5d-lottery-how-to-play-and-win

For more details on daily updates please visit us via website:

Website: https://in999.best/

Brand: In 999

Phone: +91 77150 44564

Address: andheri, Mumbai, Maharashtra

Email: in999best@gmail.com

Hagtag: #in999 #in999register #in999login #in999app

Related articles:

https://in999.best/in999-download/

https://in999.best/in-999-login/

https://in999.best/in-999-register/

https://in999.best/in999-casino/

https://in999.best/in999-sports/

https://in999.best/in999-slots/

https://in999.best/in999-lottery/

https://in999.best/in999-policy/

https://in999.best/in999-withdraw-guide/

https://in999.best/in999-support/

https://in999.best/in999-deposit-guide/

https://in999.best/baccarat-learn-rules-strategies-and-winning-tips/

https://in999.best/online-roulette/

https://in999.best/dragon-tiger/

List link share:

https://www.pinterest.com/pin/901001469199799237/

https://x.com/in999best1/status/1880454921633558945

https://www.vevioz.com/post/1288522_5d-lottery-how-to-play-and-win-the-5d-lottery-on-in999-is-a-engaging-game-where.html

https://list.ly/i/10585028

https://myspace.com/in999best/post/activity_profile_29347994_2ef5f7f14d1e45c8ab9ae238c0eebd66/

https://www.linkedin.com/posts/in999best1_in999-in999register-in999login-activity-7286221225108873217-ukuk/

https://www.deviantart.com/xembdco/art/1148143707

https://pastelink.net/ghyzrctd

https://in999best.tawk.help/article/5d-lottery-how-to-play-and-win

https://in999best.bcz.com/2025/01/18/5d-lottery-how-to-play-and-win/

The 5D Lottery on In999 is an engaging game where players select a unique five-digit number, ranging from 00000 to 99999. Winning is determined by matching the drawn numbers in exact order, with substantial prizes for precise matches and potential rewards for partial matches.

How to Play the 5D Lottery on In999:

Log In to Your Account: Access your In 999 account by visiting the official website or using the mobile app. If you're new to the platform, you'll need to register an account.

Navigate to the Lottery Section: Once logged in, go to the "Lottery" section to view available games.

Select the 5D Lottery: Choose the 5D Lottery option from the list of games.

Pick Your Numbers: Select a five-digit number combination of your choice. You can manually choose each digit or use a random number generator if available.

Purchase Your Ticket: After selecting your numbers, confirm your entry and proceed to purchase the ticket. Ensure you have sufficient funds in your account to complete the transaction.

product link: https://in999.best/5d-lottery-how-to-play-and-win/

or: https://portfolium.com/entry/5d-lottery-how-to-play-and-win

For more details on daily updates please visit us via website:

Website: https://in999.best/

Brand: In 999

Phone: +91 77150 44564

Address: andheri, Mumbai, Maharashtra

Email: in999best@gmail.com

Hagtag: #in999 #in999register #in999login #in999app

Related articles:

https://in999.best/in999-download/

https://in999.best/in-999-login/

https://in999.best/in-999-register/

https://in999.best/in999-casino/

https://in999.best/in999-sports/

https://in999.best/in999-slots/

https://in999.best/in999-lottery/

https://in999.best/in999-policy/

https://in999.best/in999-withdraw-guide/

https://in999.best/in999-support/

https://in999.best/in999-deposit-guide/

https://in999.best/baccarat-learn-rules-strategies-and-winning-tips/

https://in999.best/online-roulette/

https://in999.best/dragon-tiger/

List link share:

https://www.pinterest.com/pin/901001469199799237/

https://x.com/in999best1/status/1880454921633558945

https://www.vevioz.com/post/1288522_5d-lottery-how-to-play-and-win-the-5d-lottery-on-in999-is-a-engaging-game-where.html

https://list.ly/i/10585028

https://myspace.com/in999best/post/activity_profile_29347994_2ef5f7f14d1e45c8ab9ae238c0eebd66/

https://www.linkedin.com/posts/in999best1_in999-in999register-in999login-activity-7286221225108873217-ukuk/

https://www.deviantart.com/xembdco/art/1148143707

https://pastelink.net/ghyzrctd

https://in999best.tawk.help/article/5d-lottery-how-to-play-and-win

https://in999best.bcz.com/2025/01/18/5d-lottery-how-to-play-and-win/

5D Lottery: how to play and win

The 5D Lottery on In999 is an engaging game where players select a unique five-digit number, ranging from 00000 to 99999. Winning is determined by matching the drawn numbers in exact order, with substantial prizes for precise matches and potential rewards for partial matches.

How to Play the 5D Lottery on In999:

Log In to Your Account: Access your In 999 account by visiting the official website or using the mobile app. If you're new to the platform, you'll need to register an account.

Navigate to the Lottery Section: Once logged in, go to the "Lottery" section to view available games.

Select the 5D Lottery: Choose the 5D Lottery option from the list of games.

Pick Your Numbers: Select a five-digit number combination of your choice. You can manually choose each digit or use a random number generator if available.

Purchase Your Ticket: After selecting your numbers, confirm your entry and proceed to purchase the ticket. Ensure you have sufficient funds in your account to complete the transaction.

product link: https://in999.best/5d-lottery-how-to-play-and-win/

or: https://portfolium.com/entry/5d-lottery-how-to-play-and-win

For more details on daily updates please visit us via website:

Website: https://in999.best/

Brand: In 999

Phone: +91 77150 44564

Address: andheri, Mumbai, Maharashtra

Email: in999best@gmail.com

Hagtag: #in999 #in999register #in999login #in999app

Related articles:

https://in999.best/in999-download/

https://in999.best/in-999-login/

https://in999.best/in-999-register/

https://in999.best/in999-casino/

https://in999.best/in999-sports/

https://in999.best/in999-slots/

https://in999.best/in999-lottery/

https://in999.best/in999-policy/

https://in999.best/in999-withdraw-guide/

https://in999.best/in999-support/

https://in999.best/in999-deposit-guide/

https://in999.best/baccarat-learn-rules-strategies-and-winning-tips/

https://in999.best/online-roulette/

https://in999.best/dragon-tiger/

List link share:

https://www.pinterest.com/pin/901001469199799237/

https://x.com/in999best1/status/1880454921633558945

https://www.vevioz.com/post/1288522_5d-lottery-how-to-play-and-win-the-5d-lottery-on-in999-is-a-engaging-game-where.html

https://list.ly/i/10585028

https://myspace.com/in999best/post/activity_profile_29347994_2ef5f7f14d1e45c8ab9ae238c0eebd66/

https://www.linkedin.com/posts/in999best1_in999-in999register-in999login-activity-7286221225108873217-ukuk/

https://www.deviantart.com/xembdco/art/1148143707

https://pastelink.net/ghyzrctd

https://in999best.tawk.help/article/5d-lottery-how-to-play-and-win

https://in999best.bcz.com/2025/01/18/5d-lottery-how-to-play-and-win/

0 Comments

0 Shares

54 Views

0 Reviews