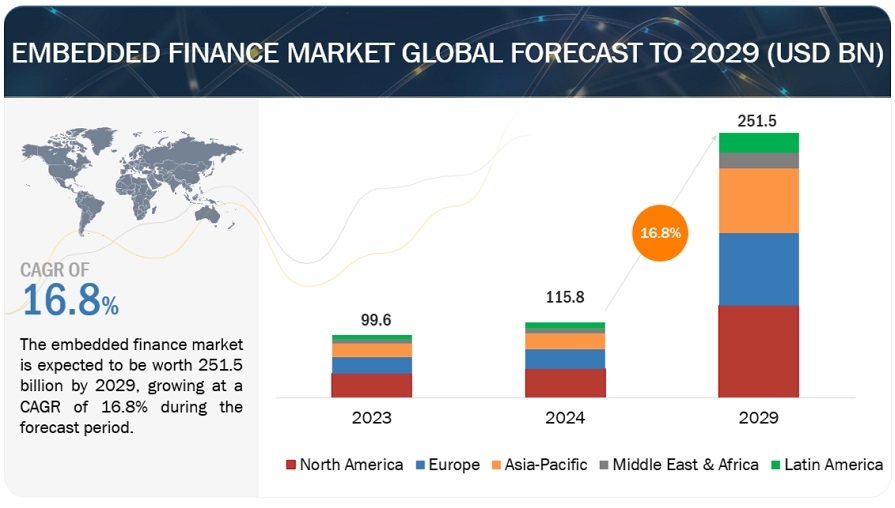

Embedded Finance Market Expected to Attain $251.5 Billion by 2029

The embedded finance market size, currently valued at USD 115.8 billion in 2024, is expected to reach USD 251.5 billion by 2029, growing at a CAGR of 16.8%.

The embedded finance market is experiencing a massive disruption because of the development of technologies such as API, AI, blockchain, etc. This capability allows companies to incorporate financial services into their platforms, delivering consistent and unique solutions. Furthermore, demand for new complex, value-added, readily available services that can be offered in real-time has pressured firms in almost all industries to embrace embedded finance. This shift helps non-financial firms to provide banking, lending, insurance, and payment services, which fortifies customer relations and generates more revenues. This market is divided into segments based on different aspects, such as the type, business model, and industry. Type includes solutions such as embedded payments, embedded lending, embedded insurance, embedded investment/wealth management, and others such as issuance and deposits. The business model includes both B2B and B2C. The industry segment focuses on retail & eCommerce, healthcare, education, telecom, transportation, mobility and logistics, travel & hospitality, and other industries, namely real estate, energy, media & entertainment, and agriculture. These segments collectively offer a comprehensive overview of the evolving embedded finance landscape and its potential business implications.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=126584658

Embedded Finance Market Dynamics:

Drivers:

· Digitization of Financial Services

· Instant Financial Operations

· Consumer Accessibility

Restraints:

· Data privacy concerns

· Data Protection Policies

· Regulatory Compliance

Opportunities:

· Financial Inclusion

· Empowering Businesses

List of Key Players in Embedded Finance Market:

· Stripe, Inc. (US)

· PayPal Holdings, Inc. (US)

· Plaid, Inc. (US)

· Klarna Bank AB (Sweden)

· FIS (US)

· Visa Inc. (US)

· Cross River Bank (US)

· Zeta Services Inc. (US)

· Marqeta, Inc. (US)

Based on industry, retail & eCommerce sector to hold the largest market size during the forecast period.

The research identified several drivers that would make the retail and e-commerce sector the most significant market for embedded finance throughout the forecast period, including the steady growth in online purchasing coupled with the rising number of digital consumers requires effective financial services integrated into the e-commerce platforms; BNPL products increase consumers’ purchasing capacity, leading to increased spending. Personalization capabilities enable retailers to offer customized financial products to their customers, enhancing satisfaction and loyalty. Secure payment gateways and other algorithms in fintech underline smooth transaction processes, leading to higher consumer confidence. An omnichannel approach that integrates both online and offline experiences has financial services that help improve the shopping experience. Growing cooperation between fintech and retailers helps to achieve significant integration and compliance with the requirements to introduce new services. At the same time, the growth of mobile commerce enhances the demand for integrated mobile payments. Collectively, these factors explain the large market size of the retail and e-commerce segment in the embedded finance market during the forecast period.

Based on the business model, the B2C model is expected to hold a higher growth rate during the forecast period.

The B2C model for embedded finance is expected to experience tremendous growth primarily because of the rising customer expectations for integrated and omnichannel financial solutions. The development of digital channels and e-commerce fuels the need for broader implementation. Innovation experiences in fintech, APIs, and AI, for instance, have helped ease integration, lowering entry barriers. Moreover, the strategic B2C model increases customer loyalty and customer retention since it provides them with individualized financial services, thus building lasting partnerships. It also widens the market since consumers who used to be locked out from accessing financial facilities due to various factors can access business ventures. Favorable economic and demographic indicators, such as improved disposable income, especially in emerging markets, as well as enhanced access to the Internet, have also boosted the demand for integrated financial services. These factors have made it evident that the B2C embedded finance model will likely realize faster growth during the forecast period under consideration.

Asia Pacific is expected to hold a higher growth rate during the forecast period.

The Asia Pacific region will have the highest growth rate in the embedded finance market for the next forecast period because of several factors. The constantly expanding digitally linked economy due to the rise in Internet connection and smartphone use makes it easier to incorporate financial services into consumer apps. The growth of e-commerce and a continuously increasing volume of online purchases, the development of the middle class and a gradual increase in the available amount of money encourage the desire to have non-cash payment solutions such as digital wallets and BNPL. State programs aimed at developing digital financial services make a helping condition, and significant investments in fintech start-ups and technological development fuel the market’s growth. A large population of the countries in this region presents a substantial demand for financial services. The tech firms collaborate with different institutions and businesses to ensure that financial services are integrated into a universal platform. All these factors combined make it possible to affirm that the Asia Pacific region will maintain a favorable, capturing growth rate in the forecast period.

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets Inc.

1615 South Congress Ave.

Suite 103, Delray Beach, FL 33445

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News