Bancassurance Market Size, Share and Industry Analysis, Report 2024-2032

Bancassurance Industry

Summary:

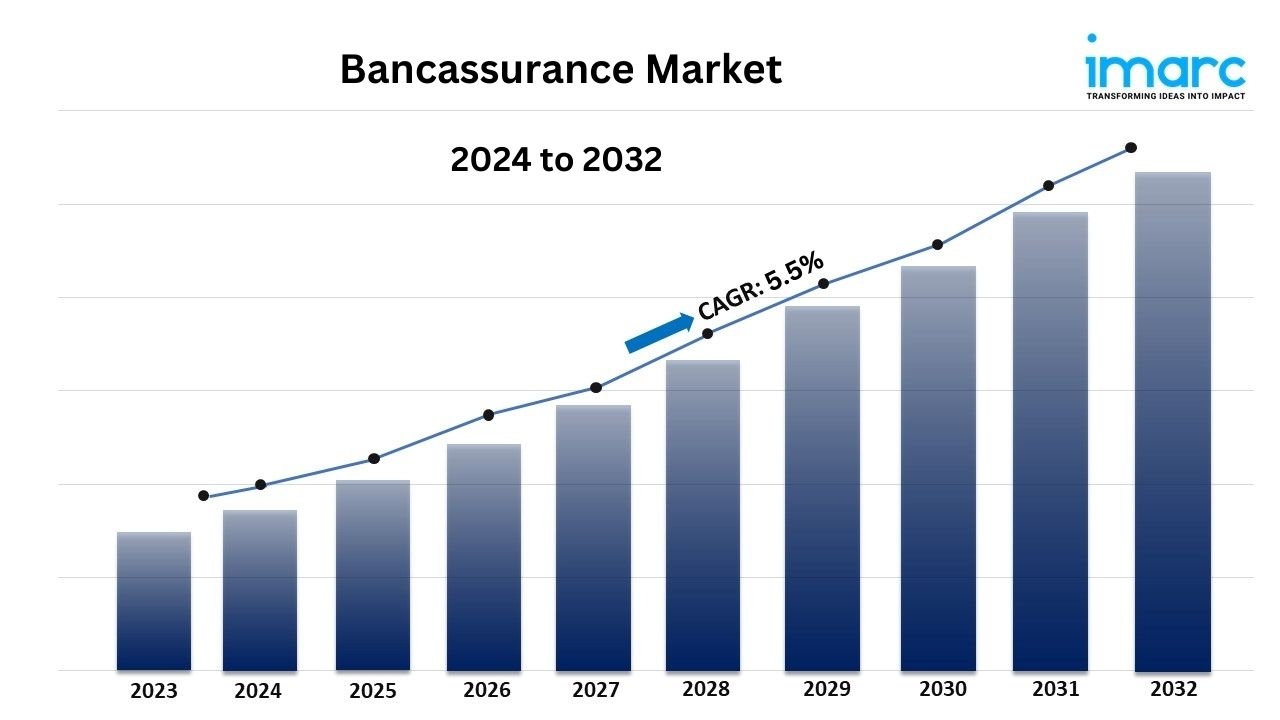

● The global bancassurance market size reached USD 1,428 Billion in 2023.

● The market is expected to reach USD 2,255 Billion by 2032, exhibiting a growth rate (CAGR) of 5.5% during 2024-2032.

● Asia Pacific leads the market, accounting for the largest bancassurance market share.

● Life bancassurance accounts for the majority of the market share in the product type segment due to the increasing demand for life insurance products among consumers seeking long-term financial security and protection, which bancassurance models effectively deliver through existing banking relationships.

● Pure distributor holds the largest share in the bancassurance industry.

● The changing consumer preferences are a primary driver of the bancassurance market.

● Technological advancements and the growing digital transformation are reshaping the bancassurance market.

Industry Trends and Drivers:

● Changing Consumer Preferences:

As consumers become more accustomed to streamlined and integrated services, they increasingly favor solutions that simplify their financial lives. Additionally, bancassurance, the collaboration between banks and insurance providers, taps into this demand by allowing customers to purchase insurance products through their trusted bank. This seamless integration provides a one-stop-shop experience where customers can manage their banking and insurance needs within a familiar environment. It saves time, reduces the complexity of dealing with multiple providers, and leads to more tailored insurance offerings, as banks have a deeper understanding of their clients’ financial behavior. Moreover, customers experience increased convenience, which enhances their overall satisfaction by bundling insurance products with banking services. The trend toward simplicity and comprehensive service offerings continues to drive the demand for bancassurance, especially as more consumers seek out services that align with their desire for efficiency and ease.

● Technological Advancements:

The rise of cutting-edge technologies, including artificial intelligence (AI) and big data analytics, has transformed the bancassurance market. These technologies are transforming how banks assess risk, underwrite policies, and deliver insurance products. Additionally, AI enables more precise risk evaluation by analyzing vast amounts of data, allowing banks to provide personalized insurance solutions tailored to individual customer needs and profiles. Moreover, with better data insights, insurers can create more accurate pricing models, improving the customer experience and profitability. Besides, AI-driven chatbots and digital assistants offer round-the-clock customer service, handling inquiries and guiding customers through their insurance options seamlessly. These technological advancements enable banks to offer innovative insurance products that are more personalized, efficient, and accessible, fostering greater customer satisfaction and loyalty. As banks continue to adopt these technologies, the bancassurance model is becoming more agile and responsive to consumer demands.

● Increasing Digital Transformation:

The digital transformation of the banking sector has opened new avenues for offering insurance products through online channels. Additionally, the rise of digital banking platforms allows consumers to explore, compare, and purchase insurance products directly from their smartphones or computers, offering a hassle-free experience. This shift to online services means that insurance solutions are more accessible to a broader audience, particularly younger consumers who prioritize convenience and speed. Moreover, enhanced digital interfaces streamline the entire insurance purchasing process, from providing quotes to completing transactions and managing policies online. Furthermore, digital transformation enables personalized marketing, where customers receive tailored insurance offers based on their financial history and preferences. This improves the purchasing experience and increases customer engagement and trust in the bank’s ability to meet its financial and insurance needs.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/bancassurance-market/requestsample

Bancassurance Market Report Segmentation:

Breakup By Product Type:

● Life Bancassurance

● Non-Life Bancassurance

Life bancassurance represents the largest segment due to the increasing demand for life insurance products among consumers seeking long-term financial security and protection, which bancassurance models effectively deliver through existing banking relationships.

Breakup By Model Type:

● Pure Distributor

● Exclusive Partnership

● Financial Holding

● Joint Venture

Pure distributor accounts for the largest market share as it allows banks to focus on their core competencies while leveraging their extensive customer base to promote insurance products without the complexities of underwriting or claims management.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific holds the leading position owing to a large market for bancassurance driven by rapid economic growth, increasing insurance penetration, and a growing middle class across the region.

Top Bancassurance Market Leaders:

● ABN AMRO Bank N.V.

● The Australia and New Zealand Banking Group Limited

● Banco Bradesco SA

● The American Express Company

● Banco Santander, S.A.

● BNP Paribas S.A.

● The ING Group

● Wells Fargo & Company

● Barclays plc

● Intesa Sanpaolo S.p.A.

● Lloyds Banking Group plc

● Citigroup Inc.

● Crédit Agricole S.A.

● HSBC Holdings plc

● NongHyup Financial Group

● Société Générale

● Nordea Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News