Banking as a Service Market Research | Industry Strengths and SWOT Analysis

Banking as a Service 2024

Banking as a Service (BaaS) represents a significant evolution in the financial services industry, offering a new model for delivering banking and financial services through technology-driven platforms. This approach enables businesses, both traditional and fintech startups, to integrate banking functionalities into their own applications or services without needing to build the underlying infrastructure from scratch. As digital transformation accelerates, BaaS is becoming a pivotal component in reshaping how financial services are accessed, managed, and delivered.

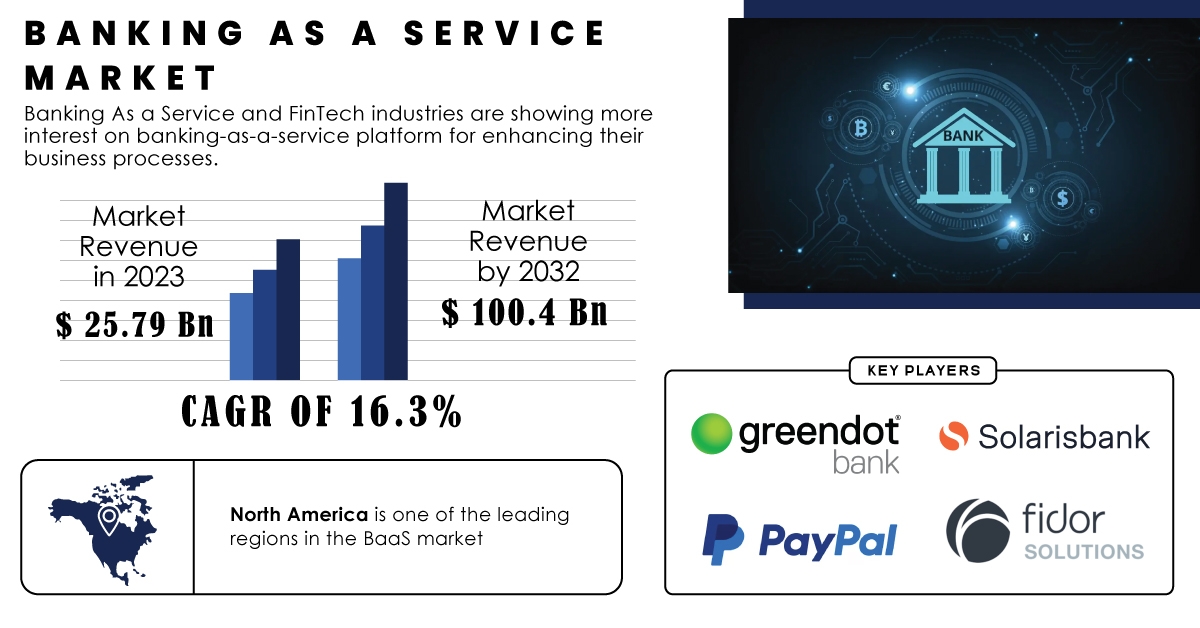

Banking as a Service Market Size was USD 25.79 billion in 2023 and is expected to reach USD 100.4 billion by 2032, growing at a CAGR of 16.3% over the forecast period of 2024-2032. This growth reflects the increasing adoption of BaaS platforms by financial institutions and technology companies seeking to leverage the flexibility and innovation that BaaS offers.

What is Banking as a Service?

Banking as a Service is a model where financial institutions provide a suite of banking products and services through APIs (Application Programming Interfaces) to third-party developers and businesses. These APIs enable businesses to integrate banking functionalities, such as payments, loans, and account management, into their own applications or platforms. By leveraging BaaS, companies can offer banking services without the need to develop or maintain the complex infrastructure required to support them.

The core concept of BaaS revolves around the seamless integration of banking services into non-banking platforms. For example, a fintech app might use BaaS to offer users the ability to open and manage bank accounts, transfer funds, or apply for loans, all within the app’s interface. This integration enhances the user experience by providing convenient and accessible banking services without requiring users to switch between different platforms.

Benefits of Banking as a Service

One of the primary benefits of BaaS is the accelerated time-to-market for new financial products and services. Traditional banking models often involve lengthy and complex processes to develop and launch new offerings. With BaaS, companies can leverage pre-built banking infrastructure and focus on creating innovative solutions and user experiences. This speed to market is especially advantageous for startups and fintech companies looking to disrupt the financial services industry.

Cost efficiency is another significant advantage of BaaS. Building and maintaining a traditional banking infrastructure requires substantial investment in technology, compliance, and operational processes. By utilizing BaaS, companies can avoid these upfront costs and operational complexities, as they are leveraging the existing infrastructure of established financial institutions. This cost-saving potential makes BaaS an attractive option for businesses looking to enter the financial services market without significant financial outlays.

Flexibility and scalability are key features of BaaS that support rapid growth and adaptation. As businesses scale, their banking needs can evolve, and BaaS platforms can easily accommodate these changes. Companies can add or modify banking services as needed, providing them with the agility to respond to market demands and customer preferences. This scalability is crucial in a dynamic and competitive financial landscape.

Another benefit of BaaS is the enhanced customer experience it enables. By integrating banking services into their own platforms, businesses can offer a more seamless and cohesive user experience. Customers can access banking functionalities alongside other services they use daily, reducing friction and increasing convenience. This improved user experience can lead to higher customer satisfaction and loyalty.

Challenges and Considerations

While BaaS offers numerous benefits, it also presents challenges and considerations that businesses must address. One of the primary challenges is ensuring regulatory compliance. The financial services industry is heavily regulated, and companies leveraging BaaS must navigate complex regulatory requirements to ensure they are operating within legal frameworks. This involves understanding and adhering to regulations related to data security, privacy, anti-money laundering, and consumer protection.

Security is another critical consideration in the BaaS model. Integrating banking services through APIs introduces potential security risks, such as data breaches and unauthorized access. Businesses must implement robust security measures to protect sensitive financial information and ensure that their BaaS providers adhere to stringent security standards. This includes employing encryption, secure authentication methods, and regular security audits.

Data management and integration can also pose challenges. Businesses must ensure that data flows seamlessly between their platforms and the BaaS provider’s infrastructure. This requires effective data management practices and integration strategies to maintain data accuracy, consistency, and integrity. Any issues with data integration can impact the quality of the user experience and the reliability of banking services.

Emerging Trends in Banking as a Service

Several emerging trends are shaping the future of Banking as a Service, reflecting advancements in technology and evolving industry needs. One notable trend is the rise of embedded finance. Embedded finance refers to the integration of financial services into non-financial platforms and applications. This trend is driven by the increasing demand for seamless and contextually relevant financial services. BaaS plays a central role in enabling embedded finance by providing the infrastructure and APIs needed to integrate banking services into diverse applications and platforms.

The adoption of artificial intelligence (AI) and machine learning (ML) is also transforming the BaaS landscape. AI and ML technologies are being used to enhance fraud detection, personalize customer experiences, and optimize financial processes. BaaS platforms are incorporating AI and ML capabilities to provide more intelligent and efficient banking services. For example, AI-powered chatbots and virtual assistants are being used to handle customer inquiries and provide personalized financial recommendations.

Blockchain technology is another trend influencing the BaaS sector. Blockchain’s decentralized and secure nature offers potential benefits for financial transactions, including enhanced transparency and reduced fraud. BaaS providers are exploring the use of blockchain for various applications, such as cross-border payments, smart contracts, and identity verification. The integration of blockchain with BaaS could lead to more secure and efficient financial services.

Conclusion

Banking as a Service is revolutionizing the financial services industry by providing a flexible, cost-effective, and scalable model for delivering banking products and services. By enabling businesses to integrate banking functionalities into their own platforms, BaaS is enhancing the customer experience, accelerating time-to-market, and driving innovation in the financial sector. While challenges related to regulatory compliance, security, and data management must be addressed, the benefits of BaaS make it a compelling choice for companies looking to capitalize on the opportunities presented by digital transformation.

As the Banking as a Service Market continues to expand, driven by the increasing adoption of technology and evolving consumer expectations, the role of BaaS in shaping the future of financial services will become increasingly significant. By embracing BaaS, businesses can unlock new possibilities, streamline their operations, and stay competitive in the rapidly evolving world of finance.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

- Banking_as_a_Service_Market

- Banking_as_a_Service_Market_Size

- Banking_as_a_Service_Market_Share

- Banking_as_a_Service_Market_Growth

- Banking_as_a_Service_Market_Trends

- Banking_as_a_Service_Market_Report

- Banking_as_a_Service_Market_Analysis

- Banking_as_a_Service_Market_Forecast

- Banking_as_a_Service_Industry

- Banking_as_a_Service_Market_Research

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News