"Beyond the Card: Future Trends in Payment Processing"

Introduction:

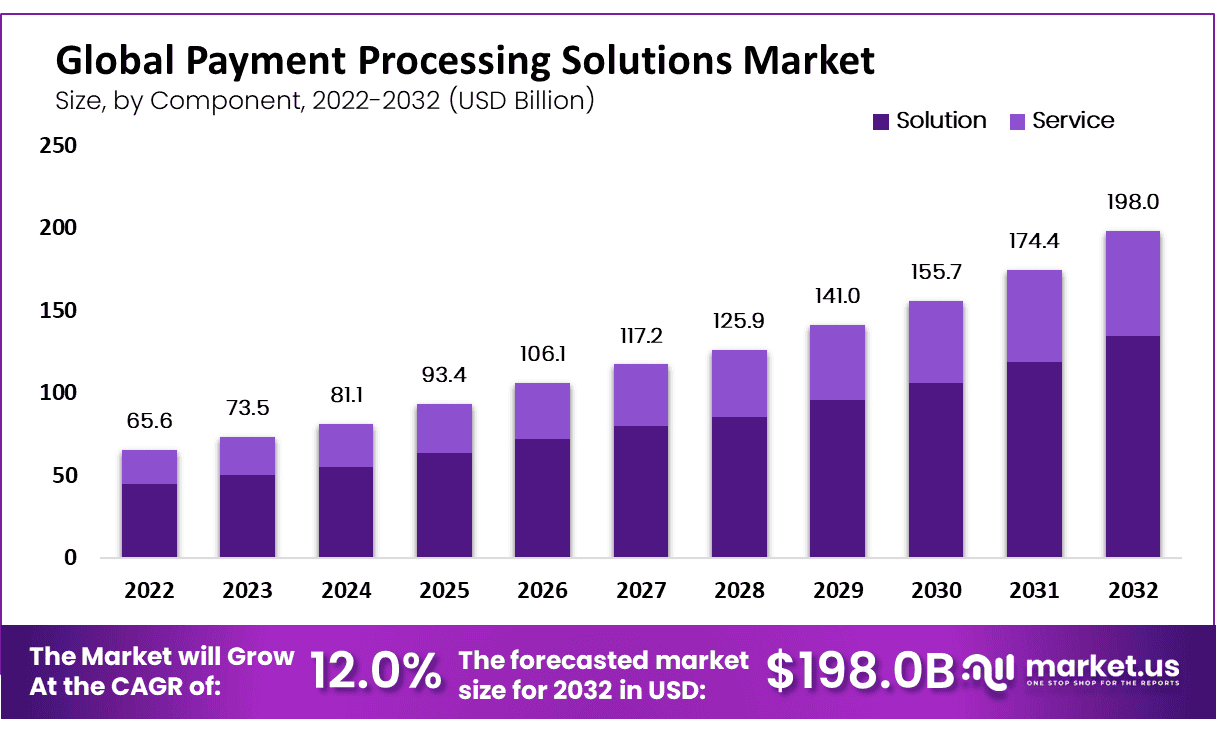

The Payment Processing Solutions Market has experienced rapid growth, driven by the global surge in digital transactions and the increasing adoption of e-commerce. The shift towards contactless payments, fueled by the pandemic, has significantly accelerated this trend.

Read More - https://market.us/report/payment-processing-solutions-market/

Growth factors include the widespread use of smartphones, the rise of digital wallets, and the increasing integration of AI and machine learning in payment systems. However, the market also faces challenges such as stringent regulatory requirements, cybersecurity threats, and the need for constant technological innovation. For new entrants, opportunities lie in tapping into emerging markets, offering innovative solutions to underserved sectors, and leveraging the growing demand for personalized payment experiences.

Emerging Trends:

-

Contactless Payments: The popularity of contactless payments, driven by convenience and hygiene concerns, continues to rise, especially in retail and hospitality sectors.

-

Cryptocurrency Integration: An increasing number of payment processors are beginning to accept cryptocurrencies, reflecting growing consumer interest and the potential for blockchain-based payment solutions.

-

AI and Machine Learning: The integration of AI and machine learning is enhancing fraud detection, personalizing payment experiences, and streamlining customer service.

-

Buy Now, Pay Later (BNPL) Services: BNPL options are becoming more prevalent, allowing consumers to make purchases and pay in installments, which is driving higher sales volumes for merchants.

-

Cross-Border Payments: There’s a growing emphasis on improving the efficiency of cross-border payments, making them faster, cheaper, and more accessible for global commerce.

Top Use Cases:

-

Retail Transactions: Payment processing solutions are vital in retail for handling in-store, online, and mobile transactions, ensuring seamless payment experiences for customers.

-

E-commerce Platforms: E-commerce businesses rely on advanced payment processing solutions to securely handle large volumes of online transactions.

-

Subscription Services: Companies offering subscription-based models depend on payment processors to manage recurring payments efficiently and securely.

-

Point-of-Sale (POS) Systems: Modern POS systems integrate payment processing solutions to offer businesses comprehensive tools for managing sales, inventory, and customer data.

-

Peer-to-Peer (P2P) Transfers: Payment solutions facilitate instant P2P transfers, allowing users to quickly send money to friends or family, a feature growing in popularity with apps like Venmo and PayPal.

Major Challenges:

-

Cybersecurity Threats: With the rise of digital payments comes an increase in cybersecurity risks, requiring constant vigilance and investment in advanced security measures.

-

Regulatory Compliance: Navigating the complex landscape of global regulations is a significant challenge, especially for companies operating across multiple regions.

-

High Competition: The market is highly competitive, with numerous players vying for market share, making it difficult for new entrants to establish a foothold.

-

Technological Integration: Ensuring seamless integration of payment processing solutions with existing business systems can be challenging and resource-intensive.

-

Consumer Trust: Building and maintaining consumer trust is crucial, as any security breach or service disruption can severely damage a brand’s reputation.

Market Opportunity:

-

Emerging Markets: There is significant potential in emerging markets where digital payment adoption is still in its early stages, offering opportunities for growth.

-

SME Solutions: Developing tailored solutions for small and medium enterprises (SMEs) can tap into a large, underserved market segment.

-

Innovation in Security: Investing in advanced security technologies, such as biometric authentication and blockchain, can provide a competitive edge.

-

Financial Inclusion: Expanding access to payment processing in underbanked regions presents a considerable market opportunity.

-

Partnerships and Integrations: Collaborating with fintech companies and other technology providers can lead to innovative products and expanded market reach.

Conclusion:

The Payment Processing Solutions Market is poised for continued growth as digital transactions become increasingly central to global commerce. While the market offers significant opportunities, particularly in emerging markets and through technological innovation, it also presents challenges such as regulatory hurdles and cybersecurity threats.

New entrants must focus on differentiation, security, and seamless integration to succeed. As the industry evolves, staying ahead of trends like contactless payments and AI integration will be key to maintaining a competitive edge. Ultimately, those who can balance innovation with consumer trust will thrive in this dynamic market.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News