In the dynamic world of investing, staying ahead of the curve requires access to the right information. One invaluable resource for investors is free stock history data. By leveraging this data, you can gain deep insights into market trends, make informed decisions, and ultimately, supercharge your investment strategy. This article will explore the benefits of free stock history data, how to access it, and ways to integrate it into your investment approach.

Understanding Free Stock History Data

Free stock history data refers to historical information about stock prices, trading volumes, and other relevant metrics over a specified period. This data is crucial for analyzing past market behavior and predicting future trends. It provides a comprehensive view of how stocks have performed under various market conditions, enabling investors to identify patterns and make data-driven decisions.

Benefits of Free Stock History Data

1. Enhanced Market Analysis

Accessing free stock history data allows investors to perform detailed market analysis. By examining historical price movements and trading volumes, you can identify trends and patterns that might not be visible in short-term data. This long-term perspective is essential for making strategic investment decisions, especially in volatile markets.

2. Risk Management

Understanding the historical performance of stocks can help you manage risk more effectively. Free stock history data enables you to assess the volatility of individual stocks and the market as a whole. By analyzing how stocks have reacted to past market downturns, you can make more informed decisions about risk mitigation and portfolio diversification.

3. Informed Investment Decisions

Having access to comprehensive stock history data empowers investors to make well-informed decisions. Whether you are a day trader or a long-term investor, historical data provides the context needed to evaluate the potential of stocks. This data helps you understand the factors that influenced past performance, which can be critical in predicting future movements.

4. Backtesting Investment Strategies

One of the most powerful applications of free stock history data is backtesting investment strategies. By simulating trades using historical data, you can evaluate the effectiveness of your investment approaches before committing real capital. This practice helps refine strategies, identify weaknesses, and improve overall performance.

Where to Access Free Stock History Data

Numerous platforms offer free access to historical stock data. Here are some popular sources:

1. Yahoo Finance

Yahoo Finance provides extensive historical stock data for free. You can access daily, weekly, monthly, and even yearly data for a wide range of stocks. The platform also offers tools for analyzing and visualizing this data.

2. Google Finance

Google Finance is another excellent resource for free stock history data. It provides historical price data along with interactive charts and comparison tools. The platform is user-friendly and allows you to easily access and analyze the data.

3. Alpha Vantage

Alpha Vantage offers free APIs that provide historical stock data. This service is particularly useful for developers and analysts who want to integrate stock data into their custom applications. Alpha Vantage offers both daily and intraday data, making it a versatile option.

4. Investing.com

Investing.com is a comprehensive financial platform that offers free historical stock data. The website provides a wide range of tools for analyzing stock performance, including technical analysis indicators and customizable charts.

Integrating Free Stock History Data into Your Strategy

1. Technical Analysis

Technical analysis involves using historical price and volume data to predict future stock movements. By studying past trends, investors can identify potential buy and sell signals. Free stock history data is essential for performing technical analysis, as it provides the necessary historical context.

2. Fundamental Analysis

While fundamental analysis focuses on evaluating a company's financial health, historical stock data can provide valuable insights. By examining a company's past stock performance, you can gauge market sentiment and investor confidence over time. This information complements financial statements and other fundamental data.

3. Algorithmic Trading

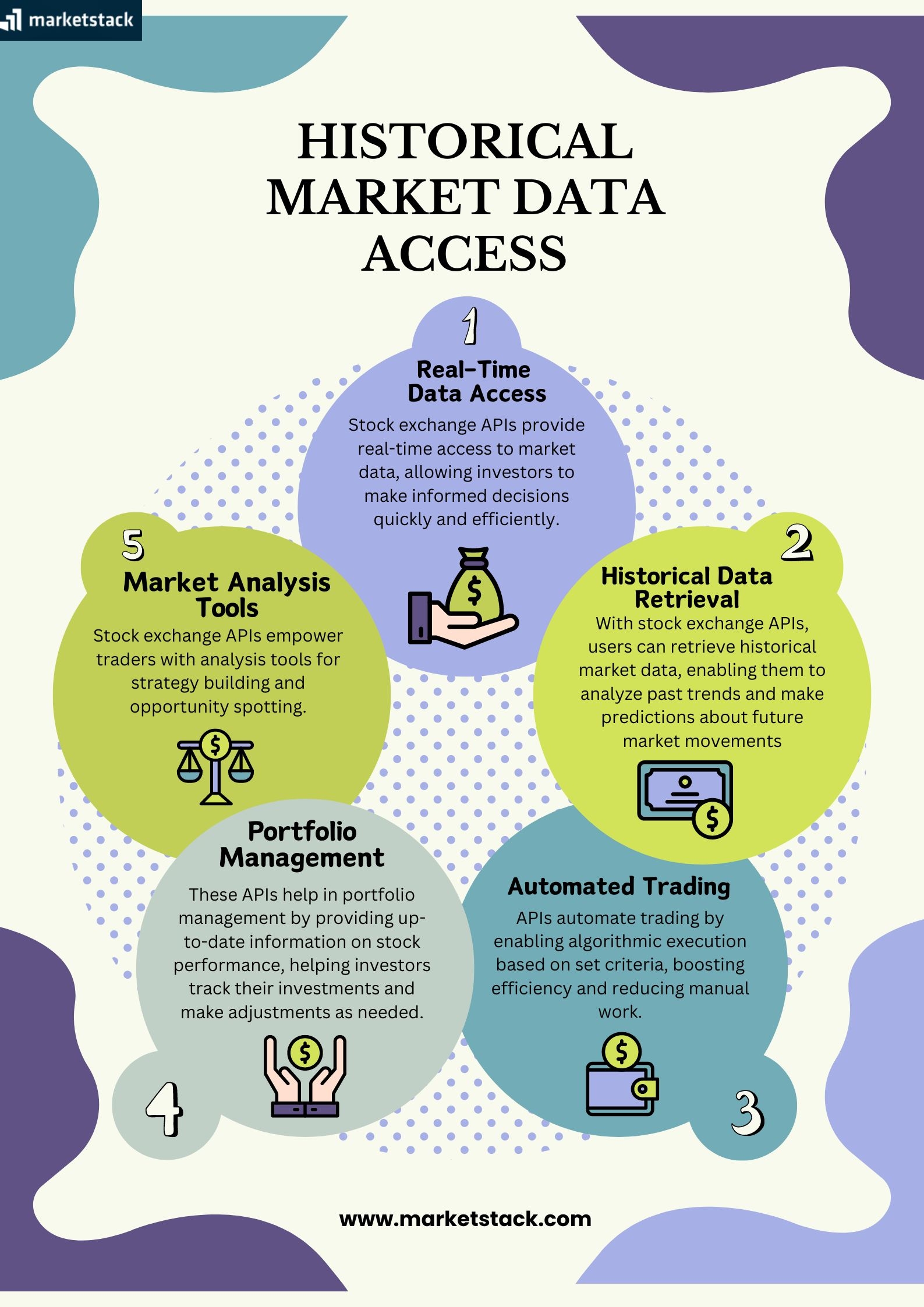

Algorithmic trading relies heavily on historical data to develop and test trading algorithms. By using free stock history data, traders can create models that predict market movements and execute trades automatically. This approach can enhance trading efficiency and profitability.

Conclusion

Free stock history data is a powerful tool that can significantly enhance your investment strategy. By leveraging this data, you can gain valuable insights into market trends, manage risk more effectively, and make informed decisions. Whether you are conducting technical analysis, backtesting strategies, or engaging in algorithmic trading, access to historical stock data is indispensable. Explore the various platforms that offer free stock history data and integrate this valuable resource into your investment approach to supercharge your strategy and achieve better outcomes.

FAQs

Q1: What is free stock history data?

Free stock history data refers to historical information about stock prices, trading volumes, and other relevant metrics over a specified period, available at no cost.

Q2: How can free stock history data enhance my investment strategy?

It provides insights into market trends, helps manage risk, supports informed decision-making, and allows for backtesting of investment strategies.

Q3: Where can I access free stock history data?

You can access free stock history data from platforms like Yahoo Finance, Google Finance, Alpha Vantage, and Investing.com.

Q4: How can I use free stock history data for technical analysis?

By examining past price movements and trading volumes, you can identify trends and potential buy/sell signals to predict future stock movements.

Q5: Can free stock history data help with algorithmic trading?

Yes, it is essential for developing and testing trading algorithms, which can enhance trading efficiency and profitability.