-

30 Posts

-

1 Photos

-

0 Videos

-

10/02/1990

-

Followed by 0 people

Recent Updates

-

Several technological advancements have changed the way we do business, and mobile payment apps are no exception. Payment apps make it easier than ever to connect with customers, clients, and vendors in new ways and on the go.

Mobile payment apps can be integrated into your cash flow model to improve the efficiency of your business and help you build trust with customers by offering fast and convenient service just with the tap of a button.

Here are seven ways mobile payment apps can benefit businesses that operate on a cash flow model.

https://www.invoicera.com/blog/cash-flow-management/how-mobile-payment-apps-are-a-boon-to-businesses-that-operate-on-cash-flow-model/Several technological advancements have changed the way we do business, and mobile payment apps are no exception. Payment apps make it easier than ever to connect with customers, clients, and vendors in new ways and on the go. Mobile payment apps can be integrated into your cash flow model to improve the efficiency of your business and help you build trust with customers by offering fast and convenient service just with the tap of a button. Here are seven ways mobile payment apps can benefit businesses that operate on a cash flow model. https://www.invoicera.com/blog/cash-flow-management/how-mobile-payment-apps-are-a-boon-to-businesses-that-operate-on-cash-flow-model/ WWW.INVOICERA.COMHow Mobile Payment Apps Are A Boon To Businesses?In this Blog, readout the seven ways mobile payment apps can benefit businesses that operate on a cash flow model.0 Comments 0 Shares 860 Views 0 ReviewsPlease log in to like, share and comment!

WWW.INVOICERA.COMHow Mobile Payment Apps Are A Boon To Businesses?In this Blog, readout the seven ways mobile payment apps can benefit businesses that operate on a cash flow model.0 Comments 0 Shares 860 Views 0 ReviewsPlease log in to like, share and comment! -

Are you saving enough for retirement? Do you have an emergency fund? Are you spending responsibly? It’s important to have a general idea of how your money is allocated, which is why developing a budget and asking yourself tough questions can make a world of difference in your financial future.

You can determine whether your budget will be effective and make the necessary changes if it isn’t. These questions are geared toward larger businesses, but one can easily adapt them to suit smaller budgets as well.

With these ten questions in mind, get started today! https://www.invoicera.com/blog/invoice-software/budgetary-control-10-questions-to-ask-when-developing-a-budget/Are you saving enough for retirement? Do you have an emergency fund? Are you spending responsibly? It’s important to have a general idea of how your money is allocated, which is why developing a budget and asking yourself tough questions can make a world of difference in your financial future. You can determine whether your budget will be effective and make the necessary changes if it isn’t. These questions are geared toward larger businesses, but one can easily adapt them to suit smaller budgets as well. With these ten questions in mind, get started today! https://www.invoicera.com/blog/invoice-software/budgetary-control-10-questions-to-ask-when-developing-a-budget/ WWW.INVOICERA.COMBudgetary Control: 10 Questions to Ask When Developing a BudgetNeed help for the budget monitoring process? Get answers to the crucial ten questions on budgeting and budgetary control.0 Comments 0 Shares 853 Views 0 Reviews

WWW.INVOICERA.COMBudgetary Control: 10 Questions to Ask When Developing a BudgetNeed help for the budget monitoring process? Get answers to the crucial ten questions on budgeting and budgetary control.0 Comments 0 Shares 853 Views 0 Reviews -

Business invoicing mistakes are all too common, but they’re easy to avoid. To start, let’s discuss some of these major errors, as well as how to deal with them. Below is a list of unpaid invoice errors you should be sure to watch out for All of these invoice errors can cause serious damage to your business relationships, so it’s important that you remain vigilant when sending out invoices and receiving payments.

As your small business grows, so do your invoice errors. To help you avoid these common mistakes, we’ve put together a list of eight invoice errors that can lead to unpaid invoices and what you can do to fix them. Small-business owners often make a number of mistakes when it comes to unpaid invoices, including sending invoices to incorrect addresses and failing to invoice on time. If you’re looking for ways to avoid these common mistakes, here are eight things you should keep in mind- https://www.invoicera.com/blog/invoice-software/unpaid-invoices-how-to-avoid-these-8-common-mistakes/Business invoicing mistakes are all too common, but they’re easy to avoid. To start, let’s discuss some of these major errors, as well as how to deal with them. Below is a list of unpaid invoice errors you should be sure to watch out for All of these invoice errors can cause serious damage to your business relationships, so it’s important that you remain vigilant when sending out invoices and receiving payments. As your small business grows, so do your invoice errors. To help you avoid these common mistakes, we’ve put together a list of eight invoice errors that can lead to unpaid invoices and what you can do to fix them. Small-business owners often make a number of mistakes when it comes to unpaid invoices, including sending invoices to incorrect addresses and failing to invoice on time. If you’re looking for ways to avoid these common mistakes, here are eight things you should keep in mind- https://www.invoicera.com/blog/invoice-software/unpaid-invoices-how-to-avoid-these-8-common-mistakes/ WWW.INVOICERA.COMUnpaid Invoices: How to avoid these 8 common mistakesLearn about unpaid invoices, invoice errors and how an online invoice software can help to avoid cash flow mistakes through online invoicing.0 Comments 0 Shares 773 Views 0 Reviews

WWW.INVOICERA.COMUnpaid Invoices: How to avoid these 8 common mistakesLearn about unpaid invoices, invoice errors and how an online invoice software can help to avoid cash flow mistakes through online invoicing.0 Comments 0 Shares 773 Views 0 Reviews -

If you want to accept recurring payments in your business it can be a little confusing at first on how you manage it. Fortunately there are a couple ways to do it. This can include #recurringbillingsoftware or through invoice management systems that have recurring payments built in. These systems not only allow you to accept recurring payments but they also help streamline your #invoicingprocess into one simple solution saving you time and money!

In order to understand why recurring payments are beneficial for businesses we need to break down exactly what #recurringpayments mean. A recurring payment is when a customer agrees to pay for goods or services on an ongoing basis rather than paying each time they receive those goods or services.

https://www.invoicera.com/blog/billing-software/want-to-accept-recurring-payments/If you want to accept recurring payments in your business it can be a little confusing at first on how you manage it. Fortunately there are a couple ways to do it. This can include #recurringbillingsoftware or through invoice management systems that have recurring payments built in. These systems not only allow you to accept recurring payments but they also help streamline your #invoicingprocess into one simple solution saving you time and money! In order to understand why recurring payments are beneficial for businesses we need to break down exactly what #recurringpayments mean. A recurring payment is when a customer agrees to pay for goods or services on an ongoing basis rather than paying each time they receive those goods or services. https://www.invoicera.com/blog/billing-software/want-to-accept-recurring-payments/ WWW.INVOICERA.COMWant to Accept Recurring Payments? It's as Easy as 1-2-3If you are willing to get started with accepting recurring payment from your customers, we recommend Invoicera invoicing software.0 Comments 0 Shares 1K Views 0 Reviews

WWW.INVOICERA.COMWant to Accept Recurring Payments? It's as Easy as 1-2-3If you are willing to get started with accepting recurring payment from your customers, we recommend Invoicera invoicing software.0 Comments 0 Shares 1K Views 0 Reviews -

A Step-By-Step Guide: Whether you’re a recent graduate or an experienced entrepreneur, it never hurts to brush up on your financial skills. With a thorough knowledge of how money flows through a business, you can more effectively budget and make decisions that will help your company succeed in achieving its goals. One crucial piece of financial information is a cash flow forecast—and it’s something that all business owners should have handy when planning their budgets for next year.

If this concept seems complicated to you, then don’t worry. We’ve outlined ten steps to help you prepare your cash flow forecast below.

https://www.invoicera.com/blog/cash-flow-management/preparing-a-cash-flow-forecast/A Step-By-Step Guide: Whether you’re a recent graduate or an experienced entrepreneur, it never hurts to brush up on your financial skills. With a thorough knowledge of how money flows through a business, you can more effectively budget and make decisions that will help your company succeed in achieving its goals. One crucial piece of financial information is a cash flow forecast—and it’s something that all business owners should have handy when planning their budgets for next year. If this concept seems complicated to you, then don’t worry. We’ve outlined ten steps to help you prepare your cash flow forecast below. https://www.invoicera.com/blog/cash-flow-management/preparing-a-cash-flow-forecast/ WWW.INVOICERA.COMPreparing A Cash Flow Forecast: A Step-By-Step GuidePrepare your own cash flow forecast with the best invoice software. Our online invoice generator and experts will help through the process.0 Comments 0 Shares 707 Views 0 Reviews

WWW.INVOICERA.COMPreparing A Cash Flow Forecast: A Step-By-Step GuidePrepare your own cash flow forecast with the best invoice software. Our online invoice generator and experts will help through the process.0 Comments 0 Shares 707 Views 0 Reviews -

A Step-By-Step Guide: Whether you’re a recent graduate or an experienced entrepreneur, it never hurts to brush up on your financial skills. With a thorough knowledge of how money flows through a business, you can more effectively budget and make decisions that will help your company succeed in achieving its goals. One crucial piece of financial information is a cash flow forecast—and it’s something that all business owners should have handy when planning their budgets for next year.

If this concept seems complicated to you, then don’t worry. We’ve outlined ten steps to help you prepare your cash flow forecast below.

https://www.invoicera.com/blog/cash-flow-management/preparing-a-cash-flow-forecast/A Step-By-Step Guide: Whether you’re a recent graduate or an experienced entrepreneur, it never hurts to brush up on your financial skills. With a thorough knowledge of how money flows through a business, you can more effectively budget and make decisions that will help your company succeed in achieving its goals. One crucial piece of financial information is a cash flow forecast—and it’s something that all business owners should have handy when planning their budgets for next year. If this concept seems complicated to you, then don’t worry. We’ve outlined ten steps to help you prepare your cash flow forecast below. https://www.invoicera.com/blog/cash-flow-management/preparing-a-cash-flow-forecast/ WWW.INVOICERA.COMPreparing A Cash Flow Forecast: A Step-By-Step GuidePrepare your own cash flow forecast with the best invoice software. Our online invoice generator and experts will help through the process.0 Comments 0 Shares 699 Views 0 Reviews

WWW.INVOICERA.COMPreparing A Cash Flow Forecast: A Step-By-Step GuidePrepare your own cash flow forecast with the best invoice software. Our online invoice generator and experts will help through the process.0 Comments 0 Shares 699 Views 0 Reviews -

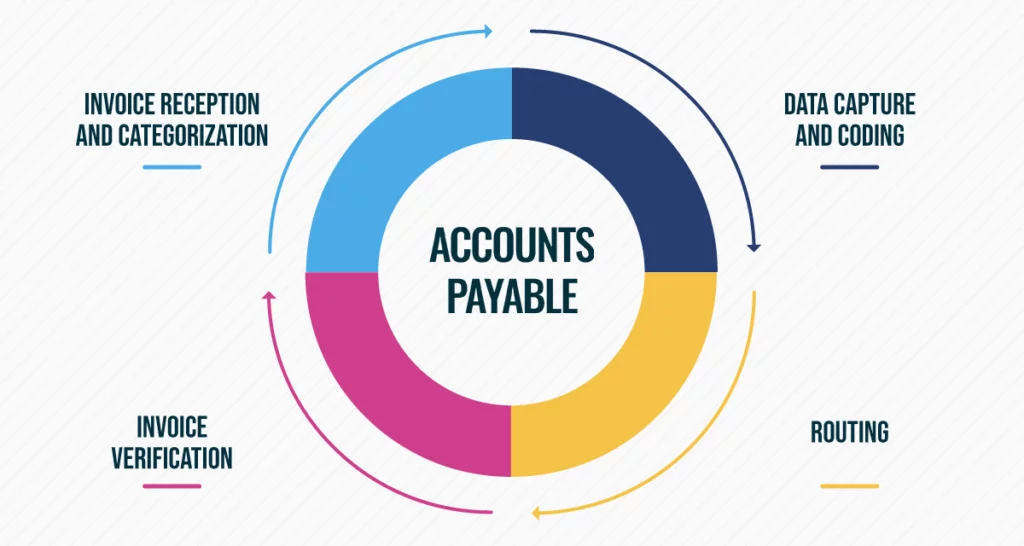

Accounts payable, which is often abbreviated as AP, refers to a department in an organization that manages payments made to suppliers and vendors. Handling accounts payable can be challenging, especially if your company deals with high volumes of invoices. Plus, you have to ensure that these invoices meet all your purchasing needs—which may include supplier discounts, specific delivery instructions and more. If your company doesn’t have an adequate tool for managing accounts payable and AP processes, then you’re probably facing some problems.

As businesses grow, they face new and bigger challenges with regards to their accounts payable process. With more employees to manage, it becomes tougher to keep track of all transactions, payables, outstanding payments and so on. Most businesses look for a way out in the form of expense management software or accounts payable software. In other words, software that can automate these payment processes. This is where Accounts Payable Challenges come into play!

Here are ten major issues every company faces and how you can solve them: https://www.invoicera.com/blog/accounts-payable/biggest-accounts-payable-challenges-every-company-is-facing/Accounts payable, which is often abbreviated as AP, refers to a department in an organization that manages payments made to suppliers and vendors. Handling accounts payable can be challenging, especially if your company deals with high volumes of invoices. Plus, you have to ensure that these invoices meet all your purchasing needs—which may include supplier discounts, specific delivery instructions and more. If your company doesn’t have an adequate tool for managing accounts payable and AP processes, then you’re probably facing some problems. As businesses grow, they face new and bigger challenges with regards to their accounts payable process. With more employees to manage, it becomes tougher to keep track of all transactions, payables, outstanding payments and so on. Most businesses look for a way out in the form of expense management software or accounts payable software. In other words, software that can automate these payment processes. This is where Accounts Payable Challenges come into play! Here are ten major issues every company faces and how you can solve them: https://www.invoicera.com/blog/accounts-payable/biggest-accounts-payable-challenges-every-company-is-facing/ WWW.INVOICERA.COM10 Biggest Accounts Payable Challenges Every Company is FacingIn this guide, we're going to share the top Accounts Payable 10 challenges that companies face in regards to accounts payable.0 Comments 0 Shares 818 Views 0 Reviews

WWW.INVOICERA.COM10 Biggest Accounts Payable Challenges Every Company is FacingIn this guide, we're going to share the top Accounts Payable 10 challenges that companies face in regards to accounts payable.0 Comments 0 Shares 818 Views 0 Reviews -

Accounts Payable (A/P) departments are responsible for handling bills that have been sent to your company and paying them as quickly as possible, in order to free up cash flow and reduce financing costs. When dealing with invoices and payments, however, there’s always the potential for human error to creep in, which can lead to late payments, fines and interest charges, or duplicate payments.

To ensure that there are no errors in accounts payable, it’s important to implement processes and procedures that help you minimize mistakes.

Here are 8 ways you can minimize errors in Accounts Payable. Luckily, there are several things you can do to reduce errors in Accounts Payable without compromising on processing speed or workflow efficiency.

https://www.invoicera.com/blog/billing-software/8-tips-to-reduce-errors-in-accounts-payable/Accounts Payable (A/P) departments are responsible for handling bills that have been sent to your company and paying them as quickly as possible, in order to free up cash flow and reduce financing costs. When dealing with invoices and payments, however, there’s always the potential for human error to creep in, which can lead to late payments, fines and interest charges, or duplicate payments. To ensure that there are no errors in accounts payable, it’s important to implement processes and procedures that help you minimize mistakes. Here are 8 ways you can minimize errors in Accounts Payable. Luckily, there are several things you can do to reduce errors in Accounts Payable without compromising on processing speed or workflow efficiency. https://www.invoicera.com/blog/billing-software/8-tips-to-reduce-errors-in-accounts-payable/ WWW.INVOICERA.COM8 Tips to Reduce Errors in Accounts PayableWhen there are errors in accounts payable, this can have a negative effect on your business’s cash flow as well as on its working capital.0 Comments 0 Shares 524 Views 0 Reviews

WWW.INVOICERA.COM8 Tips to Reduce Errors in Accounts PayableWhen there are errors in accounts payable, this can have a negative effect on your business’s cash flow as well as on its working capital.0 Comments 0 Shares 524 Views 0 Reviews -

Online invoice software is better for several reasons. One reason being that when using downloadable invoice templates you have to download, print and cut every single time you send an invoice. There's also a lot of extra work involved that an online system doesn't require. For example, if your business uses products with multiple pricing structures like multi-packs or memberships there's a lot of configuration needed on a downloadable template that an online platform takes care of automatically which will save you time down the road.

An online invoice software can help a business keep track of everything from accounts payable and receivable to subscription billing management. This not only helps them save time, but also cuts down on costs because it allows for fewer errors when it comes to bookkeeping tasks.

https://www.invoicera.com/blog/billing-software/why-is-an-online-invoice-software-better-than-downloadable-invoice-templates/Online invoice software is better for several reasons. One reason being that when using downloadable invoice templates you have to download, print and cut every single time you send an invoice. There's also a lot of extra work involved that an online system doesn't require. For example, if your business uses products with multiple pricing structures like multi-packs or memberships there's a lot of configuration needed on a downloadable template that an online platform takes care of automatically which will save you time down the road. An online invoice software can help a business keep track of everything from accounts payable and receivable to subscription billing management. This not only helps them save time, but also cuts down on costs because it allows for fewer errors when it comes to bookkeeping tasks. https://www.invoicera.com/blog/billing-software/why-is-an-online-invoice-software-better-than-downloadable-invoice-templates/ WWW.INVOICERA.COMWhy is an Online Invoice Software Better than Invoice TemplatesInvoicera, an online invoicing software acts as a guide to create invoices & manage the business. Find out other ways why you need fully packed invoicing software.0 Comments 0 Shares 761 Views 0 Reviews

WWW.INVOICERA.COMWhy is an Online Invoice Software Better than Invoice TemplatesInvoicera, an online invoicing software acts as a guide to create invoices & manage the business. Find out other ways why you need fully packed invoicing software.0 Comments 0 Shares 761 Views 0 Reviews -

Accounts payable and accounts receivable are two of the most challenging tasks for any business—not only because they require labor-intensive bookkeeping and payment processing but also because they involve so many different parties, processes, and regulations. For example, if you’re not using an online invoicing software, you might be stuck with aging paper files that make it difficult for both you and your suppliers to keep track of payments.

And if you manage your accounts payable from within Invoicera, you probably know how cumbersome it can be to find details about who owes what and when; whereas hiring someone full-time or paying for expensive accounting software may save time in the long run, neither option is likely within reach of smaller businesses.

A well-managed accounts receivable (AR) and accounts payable (AP) process can help companies boost their financial efficiency. To achieve that, invoicing software is an essential tool for businesses, particularly when it comes to automating tasks. And if you’re looking for a great online invoicing solution for your business – then look no further than Invoicera.

https://www.invoicera.com/blog/billing-software/14692/Accounts payable and accounts receivable are two of the most challenging tasks for any business—not only because they require labor-intensive bookkeeping and payment processing but also because they involve so many different parties, processes, and regulations. For example, if you’re not using an online invoicing software, you might be stuck with aging paper files that make it difficult for both you and your suppliers to keep track of payments. And if you manage your accounts payable from within Invoicera, you probably know how cumbersome it can be to find details about who owes what and when; whereas hiring someone full-time or paying for expensive accounting software may save time in the long run, neither option is likely within reach of smaller businesses. A well-managed accounts receivable (AR) and accounts payable (AP) process can help companies boost their financial efficiency. To achieve that, invoicing software is an essential tool for businesses, particularly when it comes to automating tasks. And if you’re looking for a great online invoicing solution for your business – then look no further than Invoicera. https://www.invoicera.com/blog/billing-software/14692/ WWW.INVOICERA.COMInvoicera helps Talent Aquisition Firm by providing customized softwareInvoicera takes pride in providing its client from Models Talent Aquisition industry with a customized software solution to manage their AR & AP.0 Comments 0 Shares 630 Views 0 Reviews

WWW.INVOICERA.COMInvoicera helps Talent Aquisition Firm by providing customized softwareInvoicera takes pride in providing its client from Models Talent Aquisition industry with a customized software solution to manage their AR & AP.0 Comments 0 Shares 630 Views 0 Reviews

More Stories