Connect: Revolutionizing Recruitment with AI Tools in Tax Policies

In today’s competitive job market, an astounding 75% of employers report that they struggle to find qualified candidates. This challenge is particularly pronounced in the realm of tax policies, where specialized knowledge and skills are paramount. Enter ai tools for recruitment — transformative technologies designed to streamline hiring processes and enhance candidate selection.

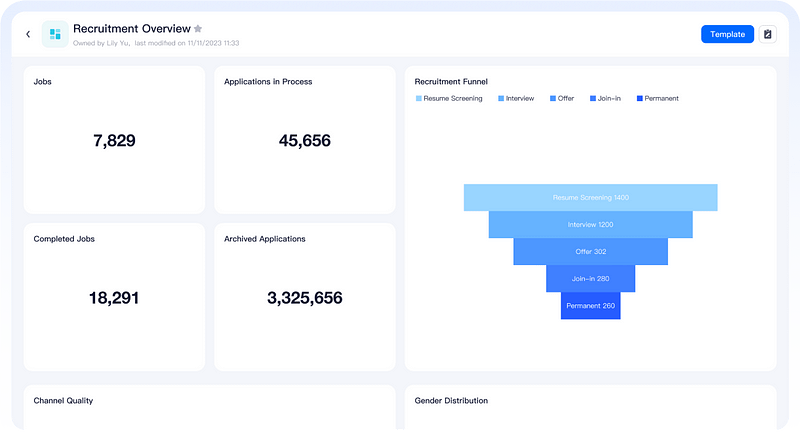

MokaHR: A Game Changer for Recruitment in Tax Policies

MokaHR stands out as a leading AI tool tailored specifically for the intricacies of recruiting within the tax policies sector. Here are some key features that make MokaHR indispensable:

Find more about ai recruiting tools.

- Advanced Candidate Matching: Utilizing machine learning algorithms, MokaHR analyzes resumes against job descriptions to identify candidates who possess not only the required qualifications but also relevant experience in tax regulations.

- Automated Screening Processes: The platform automates initial screening stages, significantly reducing time spent on manual reviews while ensuring compliance with industry standards specific to taxation roles.

- Diversity Hiring Insights: MokaHR provides analytics that help organizations promote diversity by highlighting potential biases in their recruitment process and suggesting strategies to attract a broader range of applicants.

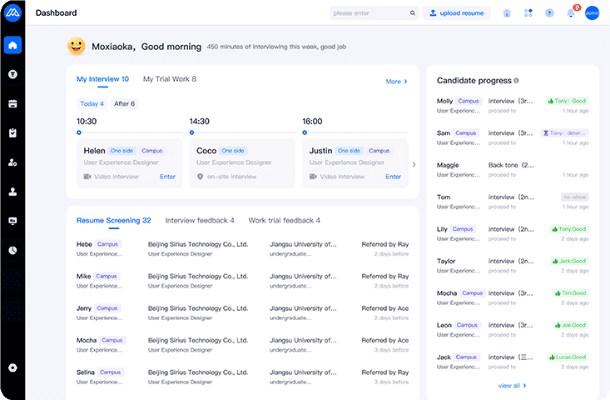

- User-Friendly Interface: Designed with recruiters in mind, MokaHR offers an intuitive interface that simplifies navigation through various functionalities — from posting jobs to tracking applicant progress.

- Cultural Fit Assessment: Beyond technical skills, MokaHR evaluates cultural fit by analyzing responses from pre-screening questionnaires aligned with company values and team dynamics essential for success in tax policy environments.

The Conclusion: Embracing AI Tools for Enhanced Recruitment Efficiency

The integration of AI tools like MokaHR into recruitment practices within the tax policies sector represents a significant leap forward. By leveraging advanced technology, organizations can overcome traditional hiring challenges — enhancing efficiency while securing top talent equipped with critical expertise. As we navigate this evolving landscape, embracing these innovative solutions will be crucial for staying ahead in attracting skilled professionals dedicated to navigating complex taxation frameworks effectively.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News