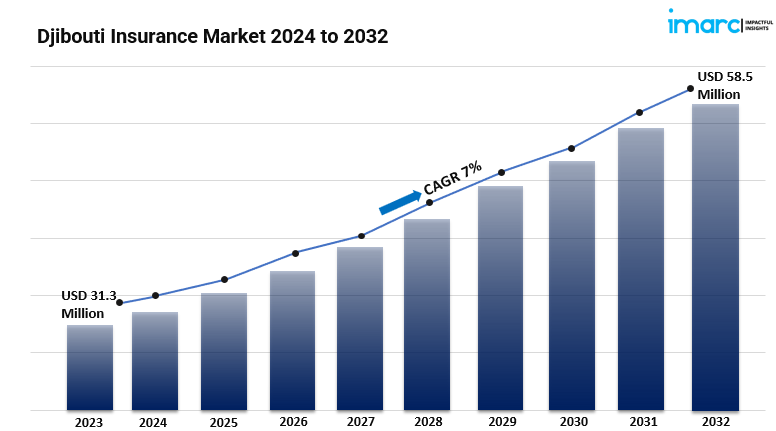

IMARC Group's report titled "Djibouti Insurance Market Report by Type (Life Insurance, Non-Life Insurance) 2024-2032". The Djibouti insurance market size reached USD 31.3 Million in 2023. Looking forward, IMARC Group expects the market to reach USD 58.5 Million by 2032, exhibiting a growth rate (CAGR) of 7% during 2024-2032.

Factors Affecting the Growth of the Djibouti Insurance Industry:

- Rising Infrastructure Development:

Market growth in Djibouti is being driven by the increasing development of infrastructure projects like port expansions and railway constructions, as well as the rising investments in the energy sector. Insurance plays a crucial role in providing a safety net against potential losses from accidents, natural disasters, and unforeseen events, thereby further contributing to the market's expansion. Insurance coverage for large-scale projects is deemed essential to safeguard investments and ensure financial stability in case of setbacks thus fueling market growth. The growing demand for comprehensive risk mitigation solutions is also driving the insurance sector's growth in Djibouti. Insurers are now focusing on offering tailored products for infrastructure projects, covering various risks such as property damage and construction delays, which is creating a positive market outlook.

- Introduction of New Insurance Products:

Insurers are realizing the significance of creating products that meet the specific needs of the Djibout, thereby supporting market expansion. Additionally, the introduction of innovative insurance options like health insurance, life insurance, insurance aims to be cost-effective for the lower-income segment, serving as a significant driver of growth. These fresh insurance offerings are customized to offer financial security against various risks, bolstering the economic stability of individuals and families. Furthermore, health and life insurance plans address the crucial requirement for medical benefits and financial assistance in times illness or death, while microinsurance makes insurance coverage more accessible to individuals who previously couldn't afford it, thus fueling market growth.

- Emergence of Technology:

Djibouti's insurance industry is undergoing a major transformation with the integration of technology, paving the way for a more of digital platforms and mobile apps is revolutionizing the way insurance products are distributed, particularly in remote and underserved regions, thereby driving market expansion. Insurers can now tap into a broader customer base, offering effortless access to information, streamlined policy purchases, and expedited claims settlement. Consumers, in turn, can browse and purchase insurance products at their convenience, anytime and anywhere, eliminating the need for in-person visits to insurance offices. The increasing digitalization of insurance is also having a profound impact on previously underserved populations, who are now able to access insurance services contributing to market growth.

Leading Companies Operating in the Global Djibouti Insurance Industry:

- AMERGA Assurance

- GXA Assurances SA.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/djibouti-insurance-market/requestsample

Djibouti Insurance Market Report Segmentation:

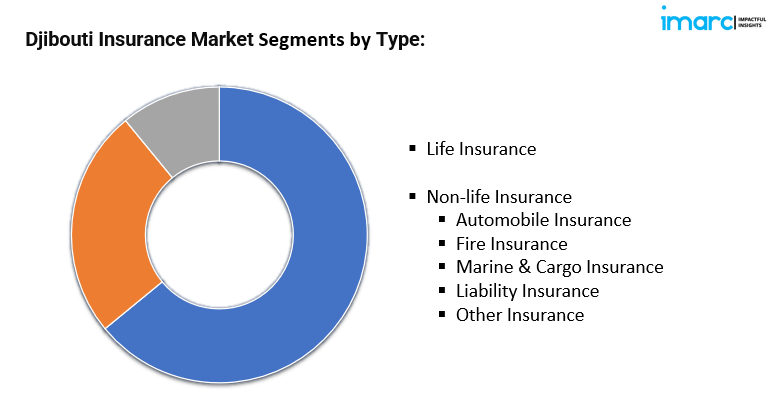

By Type:

- Life Insurance

- Non-life Insurance

- Automobile Insurance

- Fire Insurance

- Marine & Cargo Insurance

- Liability Insurance

- Other Insurance

Non-life insurance represents the largest market share due to the growing emphasis on sectors such as property, transportation, and liability coverage, and the escalating demand for non-life insurance products among businesses and individuals is contributing to the market growth.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Djibouti Insurance Market Trends:

Djibouti's insurance industry is currently undergoing significant expansion, fueled by a growing understanding of the value of insurance and rising disposable incomes among its citizens. Insurers are adapting to changing consumer demands by introducing a range, life, and microinsurance policies tailored to the local market. Strategic partnerships with global insurance companies and reinsurers are also being forged to boost underwriting capabilities, improve risk management, and drive innovation. Meanwhile, the increasing use of digital technologies, such as online platforms and mobile apps, is making insurance more accessible to a broader audience, including previously underserved communities.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145