Digital Banking Platform Market | SWOT Analysis and Strategic Insights

Digital Banking Platform 2024

Digital banking platforms are at the forefront of transforming the financial services industry, bringing unprecedented convenience, efficiency, and innovation to banking operations. As technology advances, traditional banking models are evolving to embrace digital solutions that cater to the growing expectations of tech-savvy consumers. These platforms offer a wide range of services, from basic account management to advanced financial planning tools, all accessible from a smartphone or computer. The shift towards digital banking is not just a trend but a significant evolution in how financial institutions operate and engage with their customers.

Digital banking platforms facilitate seamless, real-time financial transactions and interactions, eliminating the need for physical bank visits and reducing the reliance on traditional banking infrastructure. This transformation is driven by the increasing demand for digital convenience, the proliferation of mobile devices, and the rapid advancement of technology. As consumers seek faster, more efficient ways to manage their finances, digital banking platforms are becoming essential tools for both personal and business banking.

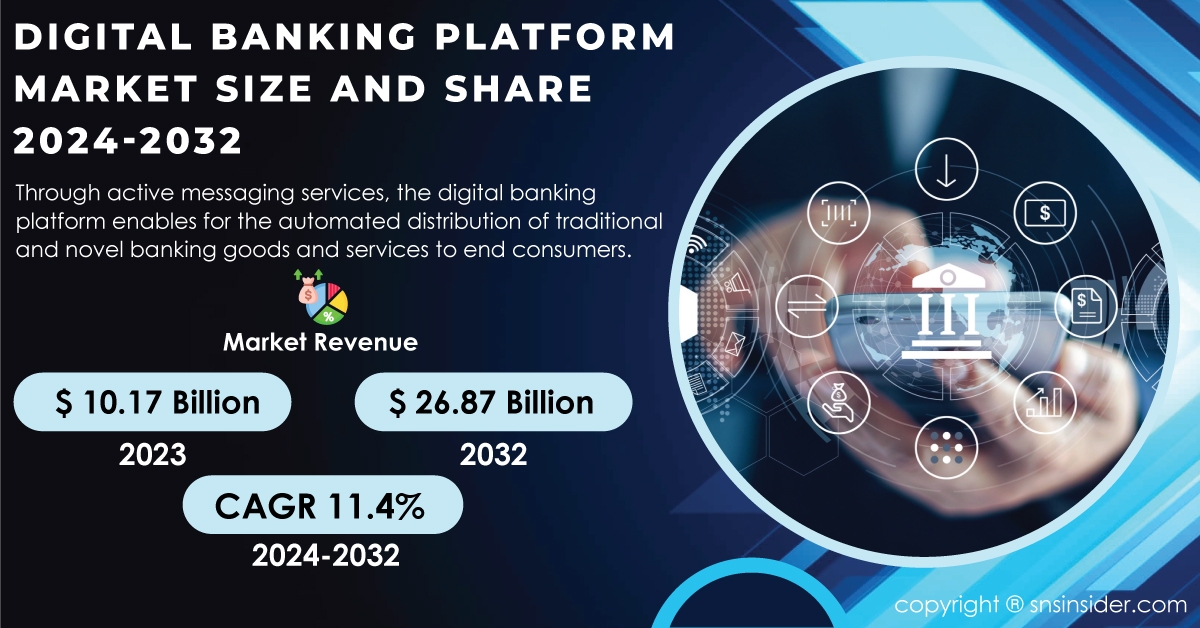

Digital Banking Platform Market Size was valued at USD 10.17 billion in 2023 and is expected to reach USD 26.87 billion by 2032 and grow at a CAGR of 11.4% over the forecast period 2024-2032.

Benefits of Digital Banking Platforms

Digital banking platforms offer a host of benefits that enhance both the customer experience and operational efficiency. One of the most significant advantages is the accessibility they provide. Customers can perform a wide range of banking activities, such as transferring funds, paying bills, and checking account balances, anytime and anywhere. This convenience is especially valuable in an era where time is of the essence, and traditional banking hours are no longer sufficient to meet consumer needs.

Additionally, digital banking platforms enable financial institutions to streamline their operations and reduce costs associated with physical branches and manual processes. Automated systems handle routine transactions and customer inquiries, freeing up human resources for more complex tasks and personalized service. This efficiency translates into lower operating costs and the ability to offer competitive services and pricing.

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) further enhances the capabilities of digital banking platforms. AI-powered chatbots provide real-time customer support, while ML algorithms analyze transaction data to offer personalized financial advice and detect fraudulent activities. These technologies not only improve the accuracy and speed of banking services but also contribute to enhanced security and risk management.

Features and Capabilities

Digital banking platforms come equipped with a wide array of features designed to meet the diverse needs of modern consumers. Core functionalities include account management, transaction history, and bill payments. Many platforms also offer advanced features such as budgeting tools, investment management, and financial planning services. These additional capabilities empower users to take control of their financial well-being and make informed decisions.

Security is a critical aspect of digital banking platforms, and robust measures are implemented to protect sensitive financial information. Multi-factor authentication (MFA), encryption, and secure protocols are employed to safeguard transactions and prevent unauthorized access. Continuous monitoring and real-time alerts further enhance security by promptly identifying and addressing potential threats.

Moreover, digital banking platforms often integrate with other financial services and third-party applications, providing a comprehensive ecosystem for managing finances. Integration with payment gateways, investment platforms, and fintech services allows users to seamlessly connect their accounts and access a wide range of financial products and services from a single interface.

The Future of Digital Banking Platforms

The future of digital banking platforms is poised for continued growth and innovation. As technology evolves, we can expect to see even more sophisticated features and capabilities emerge. The integration of blockchain technology, for example, could revolutionize transaction processing and enhance transparency and security. Additionally, the rise of open banking initiatives will enable greater collaboration between financial institutions and fintech companies, fostering innovation and expanding the range of services available to consumers.

The growing focus on customer experience will drive the development of more personalized and user-friendly digital banking platforms. Enhanced AI and data analytics will enable financial institutions to offer tailored financial solutions and proactive support, further improving customer satisfaction and loyalty. The expansion of digital banking to underserved regions and populations will also play a crucial role in increasing financial inclusion and accessibility.

In conclusion, digital banking platforms are reshaping the financial services landscape by providing convenient, efficient, and innovative solutions for managing finances. As the Digital Banking Platform Market continues to grow, driven by technological advancements and evolving consumer expectations, financial institutions must embrace digital transformation to stay competitive and meet the needs of their customers. The future of digital banking is bright, with exciting developments on the horizon that promise to further enhance the way we interact with our finances.

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Sales Performance Management Market Share

- Digital_Banking_Platform_Market

- Digital_Banking_Platform_Market_Size

- Digital_Banking_Platform_Market_Share

- Digital_Banking_Platform_Market_Growth

- Digital_Banking_Platform_Market_Trends

- Digital_Banking_Platform_Market_Report

- Digital_Banking_Platform_Market_Forecast

- Digital_Banking_Platform_Market_Analysis

- Digital_Banking_Platform_Industry

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News