Base Oil Price Analysis, Trend, Index, Chart, Forecast, Monitor, News and Historical Prices

Boron Price in India

- India: 563 USD/MT (Natural Boron Ore)

In October 2023, the Indian boron market kicked off the fourth quarter with a rise in prices, driven by heightened demand from the paint, coating, and glass sectors.

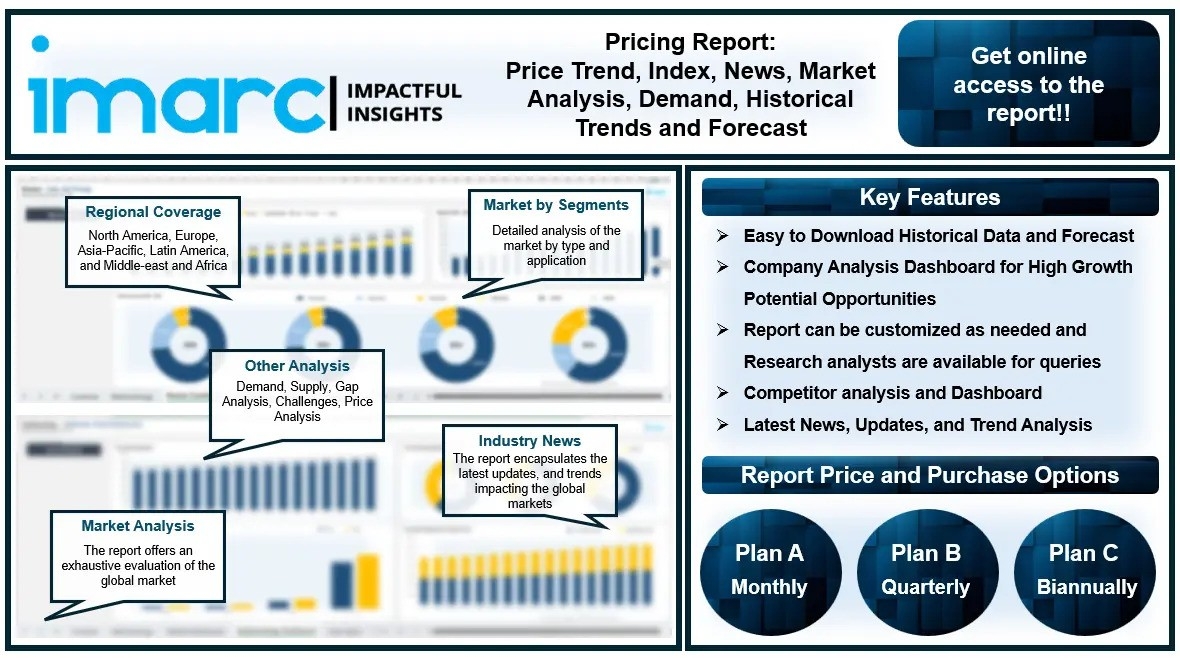

The latest report by IMARC Group, titled "Boron Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of boron prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Boron Prices December 2023:

- India: 563 USD/MT (Natural Boron Ore)

- Spain: 540 USD/MT (Natural Boron Ore)

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting boron price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/boron-pricing-report/requestsample

Boron Price Trend- Q4 2023

The boron market is driven by a diverse array of global demands, technological advancements, and strategic geopolitical investments. A primary driver is the varied application of boron across multiple industries including glass and ceramics, agriculture, and electronics, which sustains its global demand. Technological advancements in energy storage, such as battery materials where boron is used to enhance efficiency and performance, also play a crucial role. Moreover, geopolitical factors significantly influence the market; for instance, the United States' recent financial backing for rare earth projects in Australia and Brazil highlights the strategic importance of boron and other critical minerals. This support is aimed at boosting the extraction and utilization of boron, reflecting its growing importance in high-tech and green technology sectors. The market dynamics are further influenced by global economic conditions which can affect investment in mining and extraction processes. These factors collectively contribute to the complexity and vitality of the boron market, ensuring its continuous evolution and relevance in the modern industrial landscape.

Boron Market Analysis

The global boron market size reached US$ 2.3 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 3.3 Billion, at a projected CAGR of 4.20% during 2023-2032. In North America, boron prices in the last quarter were influenced by a mix of supply-demand dynamics, seasonal changes, and economic policies. The winter season typically sees a dip in construction activities, reducing demand for boron from this sector. However, stable demand from the automotive and chemical manufacturing industries helped offset some of the declines. Additionally, the United States' support for rare earth and critical minerals projects indirectly benefited the boron market by enhancing mining activities and investment in the region. These factors, combined with stable raw material prices, particularly for Ulexite, resulted in slight fluctuations in boron prices, reflecting a generally positive market sentiment despite seasonal challenges.

In the Asia-Pacific region, boron prices were affected by several factors including supply surpluses and varying demand across industries. The market witnessed a bearish trend due to high supply levels from increased mining activities, particularly in Turkey, and stable to high inventory levels in domestic warehouses. Demand was uneven, with significant reductions in sectors like construction and automotive, particularly in China, where shifts towards electric vehicles curtailed traditional boron uses. Trade disruptions, including those caused by geopolitical tensions and logistical challenges in the Panama Canal and the Red Sea, also played a role. In India, despite some sectors showing promise due to infrastructure and EV initiatives, the overall impact of reduced trade and global oversupply pressured boron prices.

The European boron market faced a downturn in the last quarter, primarily driven by decreased demand and increased supply. Key industries such as construction and automotive experienced slower activity due to severe winter conditions, reducing the need for boron. Both Turkey and Spain saw an increase in boron supply while demand remained weak, exacerbating the price decline. Trade disruptions and higher inventory levels further pressured the market. The overall bearish sentiment was compounded by economic uncertainties, leading to a notable reduction in boron prices across the region, marking a challenging period for the market.

Browse Full Report: https://www.imarcgroup.com/boron-pricing-report

Key Points Covered in the Boron Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Boron Prices

- Boron Price Trend

- Boron Demand & Supply

- Boron Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Boron Price Analysis

- Boron Industry Drivers, Restraints, and Opportunities

- Boron News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News