Insurtech Industry | Recession Impact Analysis

Insurtech Industry Scope and Overview

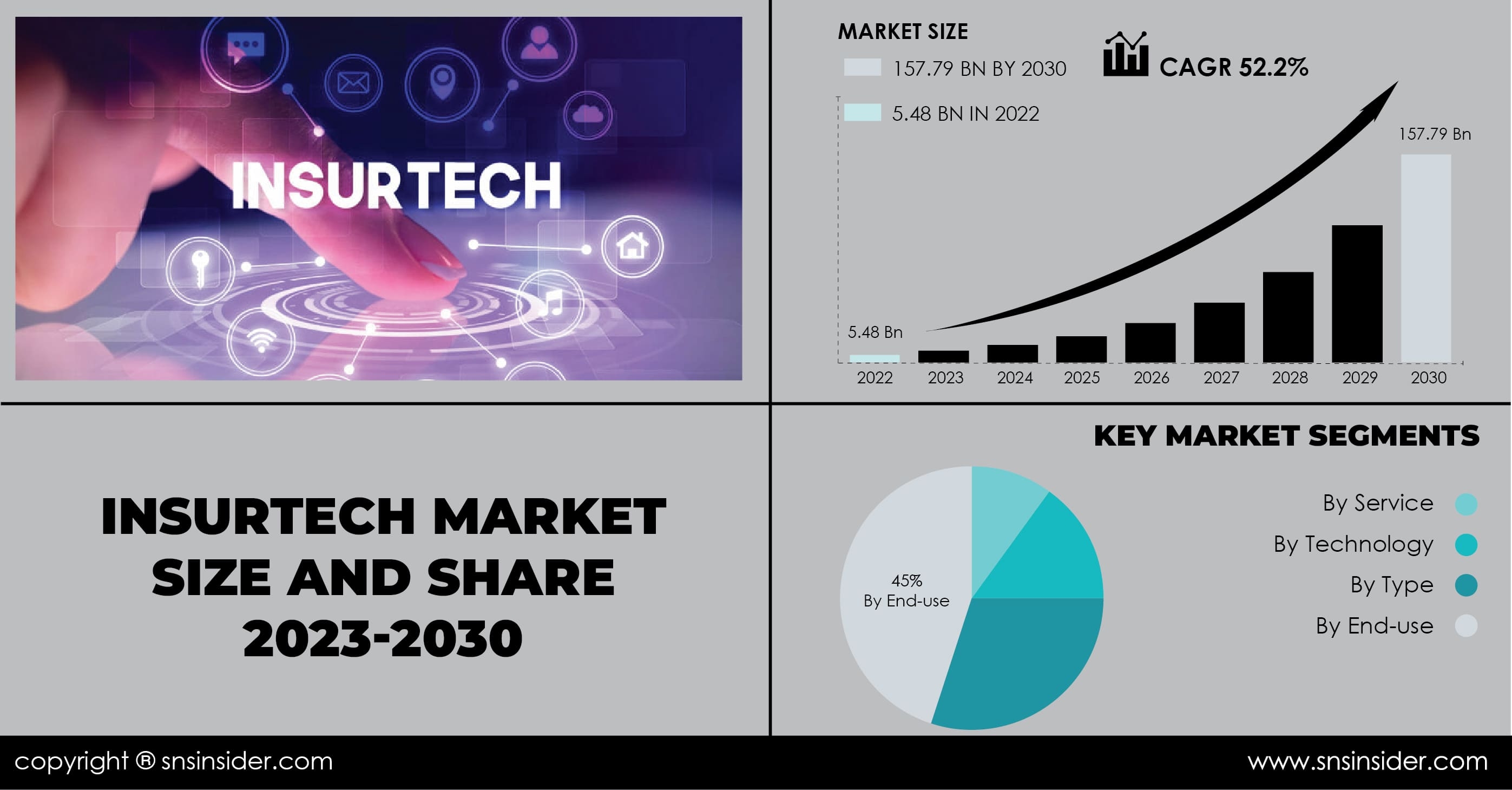

The Insurtech Industry is undergoing significant transformations, driven by technological advancements, shifting consumer preferences, and global geopolitical events. In the latest market report we delve deep into the industry landscape, offering comprehensive insights into competitive dynamics, market segmentation, regional outlook, and the impact of critical global events such as the recession and the Russia-Ukraine war. As stakeholders grapple with unprecedented challenges and seek to capitalize on emerging opportunities, our report serves as a guiding beacon, providing actionable strategies to navigate uncertainties and drive sustainable growth.

The Insurtech market combines insurance and technology to disrupt traditional insurance processes, products, and distribution channels. Insurtech companies leverage technologies such as artificial intelligence, data analytics, and blockchain to enhance customer experience, automate underwriting and claims processing, and develop innovative insurance products. As the insurance industry faces challenges such as changing customer expectations, evolving risk landscapes, and digital disruption, the demand for insurtech solutions is growing. This market expansion is driven by factors such as the need for digital transformation, the rise of on-demand insurance offerings, and increasing investment in insurance technology startups.

Competitive Analysis

The competitive analysis section of our report provides a thorough examination of the Insurtech Industry's competitive landscape, shedding light on key players, their strategies, and market positions. Through meticulous research and analysis, stakeholders gain valuable insights into factors such as market share, product innovation, distribution channels, and geographic reach.

Key players within the Insurtech Industry are evaluated based on their strengths, weaknesses, opportunities, and threats (SWOT analysis), enabling stakeholders to benchmark their performance and identify areas for strategic collaboration or differentiation. Recent developments such as mergers, acquisitions, partnerships, and product launches are also scrutinized to provide stakeholders with a comprehensive understanding of the competitive dynamics shaping the industry.

Some of the Major Key Players Studied in this Report are:

- Majesco

- Oscar Insurance

- Quan Template

- Shift Technology

- Trov Insurance Solutions

- Wipro Limited

- ZhongAnInsurance

- OutSystems

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Others

Market Segmentation Analysis

Our report offers a detailed market segmentation analysis, categorizing the Insurtech Industry based on various parameters. This segmentation enables stakeholders to identify specific market segments with high growth potential and tailor their strategies accordingly.

Market Segmentation and Sub-Segmentation Included Are:

by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

by Service:

- Consulting

- Support & Maintenance

- Managed Services

by Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

by End-use:

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Regional Outlook

The regional outlook section of our report offers a comprehensive analysis of the Insurtech Industry across key geographic regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region is evaluated based on factors such as market size, growth potential, regulatory environment, and competitive landscape.

Impact of the Recession

The global economic recession has had a profound impact on the Insurtech Industry, influencing consumer behavior, investment patterns, and market dynamics. As disposable incomes shrink and consumer confidence wanes, demand may experience a downturn. The recession has disrupted global supply chains, leading to material shortages, production delays, and increased costs. Stakeholders must diversify their supply chains, optimize inventory management, and explore alternative sourcing strategies to mitigate risks. Economic uncertainty and job losses have resulted in reduced consumer spending, particularly on non-essential goods and services. Stakeholders must reassess their pricing strategies, target value-conscious consumers, and innovate cost-effective solutions to maintain market share. Businesses may postpone capital expenditures and investment projects in response to economic uncertainty, affecting demand. Stakeholders must provide compelling value propositions, demonstrate ROI, and offer flexible financing options to stimulate investment.

Impact of the Russia-Ukraine War

The ongoing Russia-Ukraine war has added another layer of complexity to the Insurtech Industry, disrupting global supply chains, geopolitical stability, and investor confidence. The conflict has led to material shortages, production disruptions, and increased geopolitical risks, impacting the Insurtech Industry in several ways. Heightened geopolitical tensions and trade disruptions pose risks to international trade and investment flows. Stakeholders must navigate regulatory complexities, geopolitical risks, and trade barriers to maintain market access and competitiveness. The war has contributed to increased market volatility and uncertainty, affecting investor sentiment and capital markets. Stakeholders must adopt a proactive approach to risk management, diversify their investment portfolios, and maintain financial resilience in volatile market conditions.

Conclusion

In conclusion, our report on the Insurtech Industry provides comprehensive insights into competitive dynamics, market segmentation, regional outlook, and the impact of critical global events such as the recession and the Russia-Ukraine war. As stakeholders navigate through unprecedented challenges and seek to capitalize on emerging opportunities, our report serves as a roadmap for success, offering actionable strategies to drive sustainable growth and resilience in the face of uncertainty.

By understanding the competitive landscape, market dynamics, and global trends, stakeholders can make informed decisions, mitigate risks, and seize opportunities for innovation and growth in the Insurtech Industry. As the industry continues to evolve, our report empowers stakeholders to adapt, innovate, and thrive in a rapidly changing business environment.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Insurtech Market Segmentation, by Type

- Insurtech Market Segmentation, by Service

- Insurtech Market Segmentation, by Technology

- Insurtech Market Segmentation, by End-use

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Video Conferencing Market Share

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News