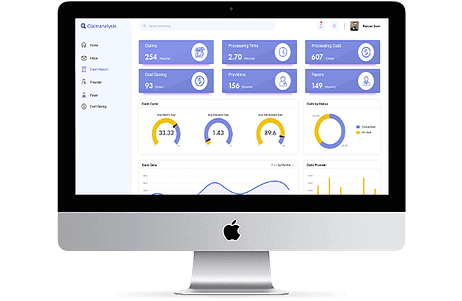

Claims analytics is the assessment of data from medical claims to identify useful insights. Healthcare claims analytics enable insurance payers to optimize their operations and serve their stakeholders better.

How does data analytics add value to the insurance sector?

Analyzing long-term claims data enables precise evaluation, facilitating accurate assessment of risks, determination of treatment costs, premium setting, etc. Essentially, healthcare claims analytics helps in making well-informed decisions and adding value for patients, providers, and payers.

What benefits can be derived from insurance analytics solutions?

-Reduction in Claims Fraud:

Insurance analytics solutions significantly contribute to fraud detection and prevention. By scrutinizing claims data for irregularities or inconsistencies, payers can effectively identify and mitigate fraudulent claims.

-Accurate Risk Assessment:

Accurately assessing risks is crucial for payers to set optimal premiums and provide suitable coverage to their plan members. Healthcare claims data analytics helps in identifying risks precisely.

-Informed Decision-Making:

Insurance claim analytics provides valuable insights into various healthcare industry factors. These insights aid payers in making informed decisions.

-Enhanced Revenue:

Insights derived from analytics enhance operational efficiency, reduce overhead, minimize fraud losses, and ultimately increase overall revenue.

What factors to consider when using health insurance claims data?

-

Nature of Claims: Considering the type of claims is crucial in collecting data for analysis. Even for the same illness, two or more claims might differ significantly.

-

Time: The processing time for claims varies, ranging from a few days to several weeks or even months, depending on their nature.

-

Data Integrity: Data integrity is vital. Claims must align with policies, regulations, proper formatting, and consistent standards.

-

Establishing Parameters: Health insurance analytics is important to define specific parameters, such as spending patterns, treatment frequencies, and admission rates for certain diseases. Analyzing data from multiple claims can shed light on these aspects.

How is the insurance claims process carried out?

-

After a clinic visit, claims are prepared by the provider for the insurance payer, excluding patient payments.

-

The payer adjudicates the claim, checking for accuracy, service coverage, and compliance.

-

Depending on the health plan, the payer covers the entire or partial cost of medical services. In the case of partial coverage, patients pay the remaining cost.

-

If the payer identifies issues with the claims, they may deny or reject the claim based on the severity of the problem.

-

Additionally, payers send an Explanation of Benefits (EOB) statement.

How can customized insurance analytics ease the processing of insurance claims data?

Predictive analytics in insurance enable the real-time sharing of claim updates. Custom predictive modeling compares factors related to new and pending claims with historical losses. Insurance claim analytics solutions help in efficient data processing.

Conclusion:

Healthcare claims analytics is crucial for fraud detection, risk assessment, and informed decision-making, ultimately boosting revenue. Custom predictive analytics in insurance analytics provides precise claim statistics, helping traders in informed decision-making.