How Is Emergency Lighting Market Growing due to Government Regulations?

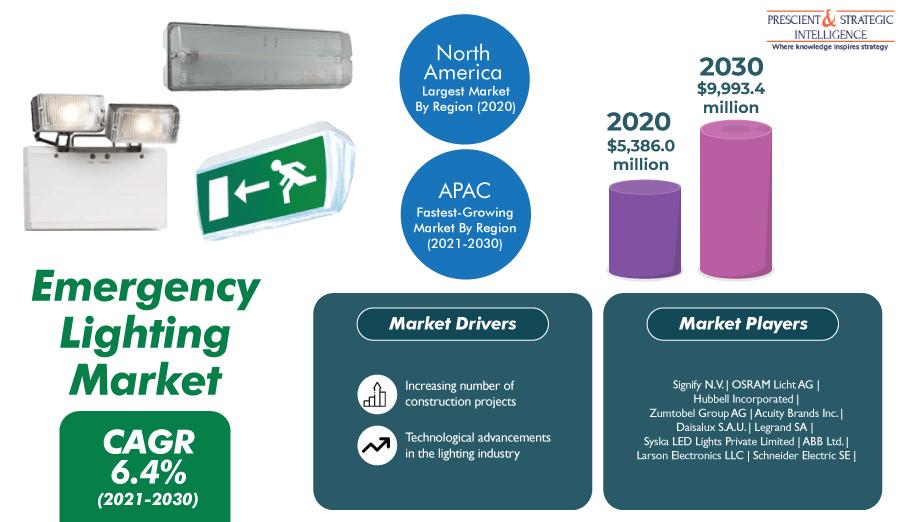

The prices of light-emitting diodes (LEDs) are decreasing, while the number of construction projects is rising. These are to be the key factors in the advance of the emergency lighting market revenue from $5,386.0 million in 2020 to $9,993.4 million by 2030 at a 6.4% CAGR between 2021 and 2030 (forecast period). Other key reasons behind the growth of the market are the technological advancements in such products and government regulations mandating their installation due to the rising focus on safety.

The categories of the battery type segment are nickel–cadmium (Ni–Cd), nickel–metal hydride (Ni–MH), lithium-ion (Li-ion), and lead–acid. Among these, the highest revenue in the market in 2020 was generated by the Li-ion category, which is expected to hold on to its industry dominance throughout the forecast period. This would be because compared to other types of batteries, Li-ion batteries have a higher energy density, which leads to longer operations. Moreover, these batteries have a longer life, which reduces the need to replace them, thus saving money.

Based on light source, the emergency lighting market categories are fluorescent, incandescent, LED, induction, and others. The largest contribution to the market during the historical period (2014–2020) was made by the LED category, which will also experience the highest CAGR over the forecast period. Compared to other technologies, LED is a lot energy-efficient, and it also lasts longer. This is why many governments have started replacing conventional lights with LEDs. Further, the plunging prices of LEDs are driving the market by leading to their burgeoning sales.

The application segment of the emergency lighting market is categorized into residential, industrial, commercial, and others, which includes shipyards, railway stations, and airports. In 2020, the commercial category held the largest share because of the mandatory installation of such fixtures at places with a high footfall, such as shopping malls, hotels, hospitals, and office buildings. During the forecast period, the residential category will advance the fastest because of the rampant construction of residential units around the world, especially in the Middle East and Africa (MEA) and Asia-Pacific (APAC).

Thus, the burgeoning number of construction projects is the biggest market driver. With the increasing concerns being raised over tenant and employee safety, emergency lights are being installed in almost all new industrial, residential, commercial, and government buildings. In this regard, the rampant urbanization and construction of houses, office buildings, hospitals, universities, restaurants, shopping complexes, hotels, and factories are helping market players gather high revenue. For instance, these lights will be procured in monumental numbers for the 100 smart cities being developed in India.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News