RV Industry:THOR INDUSTRIES (#THO)

In the context of social distancing, vacations on wheels are the best solution for safe vacations and traveling long distances.

“Prepare the sleigh in the summer and the cart in the winter” is a American proverb.

Thor Industries (tick on SPB: THO)

Purchase: no more than $104

Target: $120(+25%)

Horizon: 6 months

OVERVIEW

THOR INDUSTRIES (#THO) is the industry's largest manufacturer of travel trailers, trailers, and motorhomes. The American company was founded on August 29, 1980, sells specialized vehicles, components, and various accessories to independent dealers in the US, Canada, and Europe. Thor is the #1 player in terms of sales and operations in North America. It has also become one of the leaders in the European RV industry with the acquisition of the Erwin Hymer Group (EHG) last February.

Thor operates in the following areas (chart #1): towed travel trailers (accounting for 54.9% of total revenue - in the US), mobile homes - 19.5% (in the US), the share of sales of all products in Europe - 23.7%, spare parts and accessories - 1.9%.

INVESTMENT ATTRACTIVENESS OF THOR

◼️ The acquisition of the German company Erwin Hymer Group (EHG), Europe's leading motorhome manufacturer, makes Thor the largest motorhome manufacturer. EHG's strength in technology development and efficiency complements Thor's position in the North American and European markets. The buyout bolstered Thor's position and the deal provides the firm with an opportunity for long-term growth. Also, the acquisition of TiffinHomes will help Thor expand its existing portfolio. These acquisitions are in line with Thor's long-term strategy of acquiring successful companies with strong management teams and an excellent product line.

◼️ Since May, the company has increased sales and reduced inventory, especially in the North American market. According to management, this trend will continue. Amid the coronavirus panic, vans seem to be the safest travel option as they allow people to enjoy their holidays with their families while still maintaining self-isolation. Towed motorhomes are gaining popularity around the world and are expected to continue to grow for the foreseeable future. Increasing Airstream 's production capacity will boost revenue in the future given the fact that it is an iconic brand in the RV industry.

◼️ In response to the COVID-19 crisis, the company has initiated a series of austerity measures, including employee layoffs, pay cuts, reductions in CEO remuneration, and reductions in discretionary spending, the ultimate goal of which is to increase business profits. These measures will give some respite amid margin problems. The company remains optimistic about achieving its ambitious target of $14 billion in annual net sales by the end of fiscal 2025.

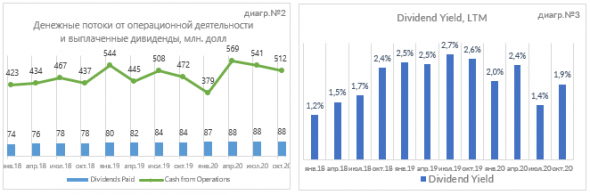

Thor manages cash flow well, a key metric for measuring a firm's performance. Net cash from operations in 2018, 2019 and 2020 was $466.5 million, $508 million and $540.9 million, respectively. The Airstream RV manufacturer in Tennessee aims to add value to shareholders. It is noteworthy that the company has regularly increased dividends for 10 years in a row. While most companies have opted to suspend dividends amid the financial crisis caused by the coronavirus. Thor intends to stay on course, which is a boon for investors.

◼️ Thor manages cash flow well - this is a key indicator for measuring the effectiveness of a firm. Net cash from operations in 2018, 2019 and 2020 was $466.5 million, $508 million and $540.9 million, respectively. The RV manufacturer aims to add value to shareholders. It is noteworthy that the company has regularly increased dividends for 10 years in a row. While most companies have opted to suspend dividends amid the financial crisis caused by the coronavirus. Thor intends to stay on course, which is a boon for investors.

PROFIT ANALYSIS AND FORECAST

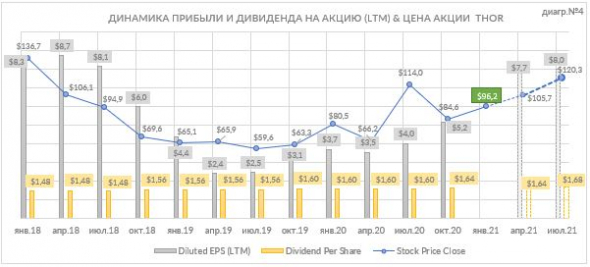

Starting from July 2019, a change from a downward trend to an upward one can be clearly seen (diagram No. 4). As you can see, stocks are trending higher, and the magnitude of these changes looks promising. According to preliminary calculations, earnings per share (EPS), in annual terms, tends to increase by 3% per quarter, which means that after 6 months (peak season and close of Thor's financial year), EPS with a probability of 80% will be $ 8.0 per share . As a result of good operating performance, Thor's shares have every chance to grow to $120 per share (+25%) by this time.

Comparison with competitors and risk analysis

On December 21, 2020, Thor announced the acquisition of TiffinHomes, Inc. and related companies in the amount of $300 million.

One of the main achievements of the company is the creation of the first fully autonomous trailer. The main credo of Airstream trailers is self-sufficiency, design, quality, and use of innovative ideas. This is the basis for the successful work of the company, which has been on the market for more than 80 years.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News