India Electric Bike Market to Witness Growth Acceleration During 2020-2025

The World Air Quality Report 2020 states that the annual average particulate matter (PM) 2.5 concentration in India was 51.9 µg/m³ in 2020. According to this report, the highest concentration of PM 2.5 was recorded in Delhi (84.1 µg/m³), in 2020. The report further states that 22 of the top 30 most polluted cities of the world are located in India. The transportation sector is one of the largest emitters of pollutants in the country, as per the report. Furthermore, the World Bank states that 2,434,520 kilotons (kt) of carbon dioxide (CO2) were emitted in India in 2018.

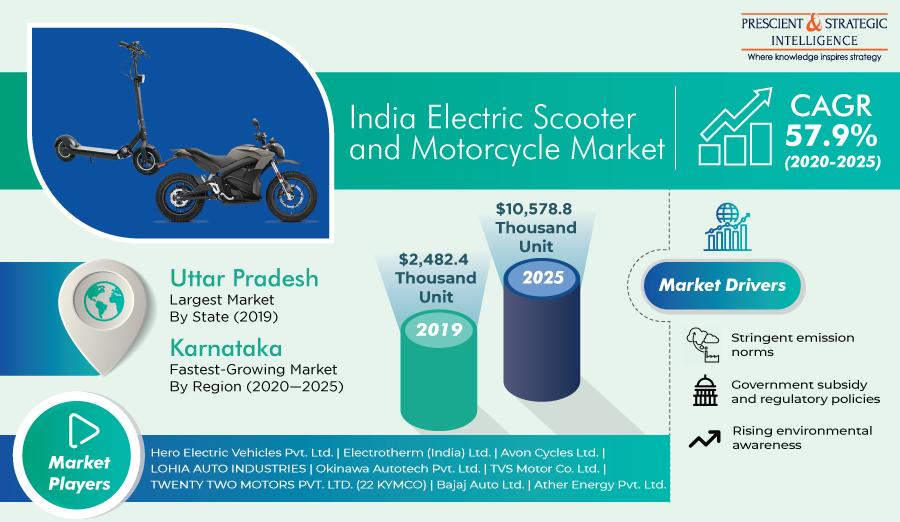

Thus, the extensive emission of CO2 and PM in the country, primarily on account of the extensive usage of oil and diesel-powered vehicles, will help the Indian electric scooter and motorcycle market to progress at 57.9% CAGR during 2020–2025. The sales of electric scooters and motorcycles are expected to increase from 152.0 thousand in 2019 to 1,080.5 thousand units by 2025. Furthermore, the market is expected to generate $1,043.4 million by 2025. In an attempt to reduce air pollution levels and owing to the implementation of strict emission norms, automakers in India are largely focusing on the production of electric vehicles (EVs).

Additionally, the plunging lithium-ion (Li-ion) battery prices will also supplement the adoption of electric scooters and motorcycles in India in the forthcoming years. As battery accounts for nearly 40–50% of the total cost of an EV, battery manufacturers are focusing on the development of low-cost Li-ion batteries. Moreover, the lower weight of Li-ion batteries, as compared to that of sealed lead acid (SLA) batteries, help in enhancing the fuel efficiency of electric scooters and motorcycles, by reducing the overall weight of these two-wheelers.

Nowadays, electric scooters and motorcycles are being largely procured from online retail platforms, due to the rising internet penetration, flourishing e-commerce sector, soaring popularity of electric two-wheelers among millennials, and mounting consumer confidence in India. Besides, the ease and convenience of shopping offered by these sales channels are also encouraging users to shift from physical outlets to such virtual stores. Nowadays, manufacturers of these new energy vehicles are engaging with prospective buyers through online platforms and sharing the leads with their dealer partners, to boost their sales in India.

According to P&S Intelligence, Uttar Pradesh adopted the highest number of electric scooters and motorcycles in the recent past, due to the increasing focus of EV manufacturers on penetrating the tier 2 and tier 3 cities of the state. Additionally, these electric two-wheelers were widely preferred by end-users, due to the heavy traffic and narrow lanes of these cities, which are not viable for large vehicles. Moreover, the low operating and maintenance costs of electric scooters and motorcycles are also boosting their adoption in the state.

Whereas, Delhi and Karnataka are expected to advance at the fastest pace in the Indian electric scooter and motorcycle market in the upcoming years. This will be due to the increasing government support, rising customer acceptance for new energy vehicles, and developing EV value chain in these states. Besides, the soaring environmental concerns and escalating popularity of two-wheeler mobility services among the vast population of migrants will also augment the adoption of electric scooters and motorcycles in these states in the foreseeable future.

Thus, the escalating air pollution levels and declining Li-ion battery prices will fuel the adoption of electric scooters and motorcycles in India in the forthcoming years.

- Industry

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- News